Did you miss out on one or more Economic Impact Payments (EIP) in 2020 and 2021? PIM Savvy VITA can assist! We can help by preparing and filing a 2020 or 2021 tax return if you have not filed one yet.

Economic Impact Payments, also referred to as stimulus payments, were issued in 2020 and 2021 by the Internal Revenue Service (IRS). The IRS has issued all first, second and third Economic Impact Payments and most eligible people already received their stimulus payments. However, people who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit (RRC) on their 2020 or 2021 federal tax return. Taxpayers must first file a tax return to claim a RRC even if they had little or no income from a job, business, or other source.

The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return. These EIPs were issued in 2020 and early 2021. Missing first and second payments may only be claimed on a 2020 tax return.

The third round of Economic Impact Payments, including the plus-up payments, were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return. These EIPs were issued starting in March 2021 and continued through December 2021. Missing third payments may only be claimed on a 2021 tax return.

What are the full amounts of the first, second or third Economic Impact Payment?

- The full amount of the first Economic Impact Payment was $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child.

- The full amount of the second Economic Impact Payment was $600 ($1,200 if married filing jointly) plus $600 for each qualifying child.

- The full amount of the third Economic Impact Payment was $1,400 for an eligible individual who has a valid Social Security number (SSN) ($2,800 for married couples filing a joint return if both spouses have a valid SSN or if one spouse has a valid SSN and one spouse was an active member of the U.S. Armed Forces at any time during the taxable year) plus $1,400 for each qualifying dependent who has a valid SSN or Adoption Taxpayer Identification Number (ATIN) issued by the IRS.

How do I check if I’m missing an Economic Impact Payment or received less than the full amount for any of the Economic Impact Payments?

- The best option is to check your online IRS account. Securely access your IRS online account to view the total amount received for your first, second and third Economic Impact Payments under the Tax Records page. If you don’t have an IRS account, you can create one here.

- The next option is to check your files for the following IRS notices. If you received any of the Economic Impact Payments, the IRS mailed the corresponding notices to the address they had on file.

- Notice 1444: Shows the first Economic Impact Payment advanced for tax year 2020.

- Notice 1444-B: Shows the second Economic Impact Payment advanced for tax year 2020.

- Notice 1444-C: Shows the third Economic Impact Payment advanced for tax year 2021.

- Letter 6475: Through March 2022, the IRS sent this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments a tax filer received for the tax year 2021.

Who is eligible for Recovery Rebate Credits?

- 2020 Recovery Rebate Credit

- The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact Payments except that the credit eligibility and the credit amount are based on your 2020 tax year information.

- Tax filers were eligible for the first and second Economic Impact Payments if their adjusted gross income (AGI) did not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower;

- $112,500 if filing as head of household; or

- $75,000 for eligible individuals using any other filing status

- A tax filer’s payment would have been reduced by 5% of the amount by which their AGI exceeded the applicable threshold above.

- Generally, to claim the 2020 Recovery Rebate Credit, a person must:

- Have been a U.S. citizen or U.S. resident alien in 2020.

- Not have been a dependent of another taxpayer for 2020.

- Have a Social Security number issued before the due date of the tax return that is valid for employment in the United States.

- Tax filers were eligible for the first and second Economic Impact Payments if their adjusted gross income (AGI) did not exceed:

- The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact Payments except that the credit eligibility and the credit amount are based on your 2020 tax year information.

- 2021 Recovery Rebate Credit

- The eligibility requirements for the 2021 Recovery Rebate Credit are the same as they were for the third Economic Impact Payments, except that the credit eligibility and amount are based on your 2021 tax year information.

- Tax filers were eligible for the third Economic Impact Payment if their adjusted gross income (AGI) did not exceed:

- $150,000 if married and filing a joint return or filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing status.

- A tax filer’s payment would have been reduced if their AGI exceeded the values above.

- Tax filers were NOT eligible for the third Economic Impact Payment if their adjusted gross income was greater than or equal to the following amount:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using any other filing status.

- Generally, to claim the 2021 Recovery Rebate Credit, a person must:

- Have been a U.S. citizen or U.S. resident alien in 2021.

- Not have been a dependent of another taxpayer for 2021.

- Have a Social Security number issued by the due date of the tax return, claim a dependent who has a Social Security number issued by the due date of the tax return, or claim a dependent with an Adoption Taxpayer Identification Number.

- Tax filers were eligible for the third Economic Impact Payment if their adjusted gross income (AGI) did not exceed:

- The eligibility requirements for the 2021 Recovery Rebate Credit are the same as they were for the third Economic Impact Payments, except that the credit eligibility and amount are based on your 2021 tax year information.

*Note: The 2020 RRC can be claimed for someone who died in 2020. The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later.

What is the deadline to claim the 2020 and 2021 Recovery Rebate Credit?

- The deadline to file a return and claim the 2020 Recovery Rebate Credit is May 17th, 2024.

- The deadline to file a return and claim the 2021 Recovery Rebate Credit is April 15, 2025.

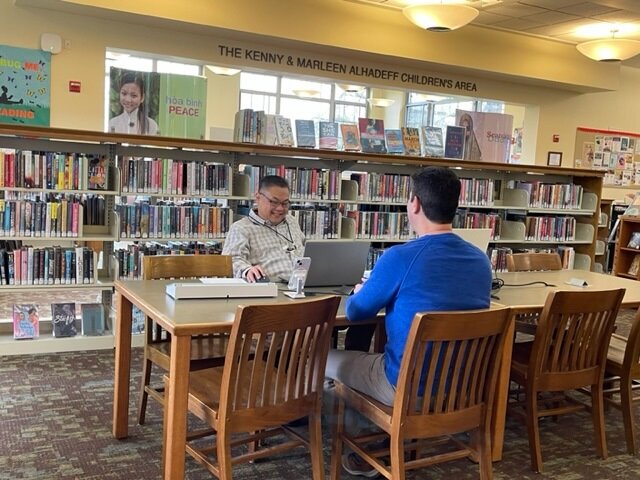

Do you have more questions or need help with your Economic Impact Payments/Recovery Rebate credit? PIM Savvy VITA is ready to help.

Call: 206-565-2961, Option 4 for English, Option 2 for Spanish

Email: vita@pimsavvy.com

Website: PIM Savvy’s Free Tax Prep (VITA) Program – PIM Savvy to see all our tax events and locations and schedule a free tax prep appointment

Visit: PIM Savvy’s VITA site in Renton is located at 707 S Grady Way, Suite 600 Renton, WA 98057 and is open on Tuesdays or Fridays. PIM Savvy’s VITA site at the Carl Gipson Center in Everett VITA is located at 3025 Lombard Ave (Mt. Adams Room) Everett, WA 98201 and is open on Mondays, through 4/15. After the 2024 tax season, our two VITA sites will continue operating in King and Snohomish counties, but the days of service and hours will change. We will ask the IRS to update the IRS VITA locator with the revised schedule once determined. The IRS VITA locator can be used to find any VITA site nationwide and is updated regularly during tax season.

Sources

IRS reminds eligible 2020 and 2021 non-filers to claim Recovery Rebate Credit before time runs out | Internal Revenue Service

Recovery Rebate Credit | Internal Revenue Service (irs.gov)

Publication 5486 (Rev. 1-2022) (irs.gov)

Publication 5486-B (1-2022) (irs.gov)

Recovery Rebate Credit and Economic Impact Payments: partner and promotional materials | Internal Revenue Service (irs.gov)