PIM Savvy's Free Tax Prep (VITA) Program

In partnership with the Washington State Department of Revenue and the Internal Revenue Service (IRS), PIM Savvy provides FREE IN-PERSON and DROP-OFF TAX PREPARATION throughout King and Snohomish Counties in Washington State. We ensure taxpayers maximize their refunds by claiming all credits they are eligible for, including the federal Earned Income Tax Credit (EITC) and Washington State’s Working Families Tax Credit (WFTC).

Book early because appointments will fill up quickly!

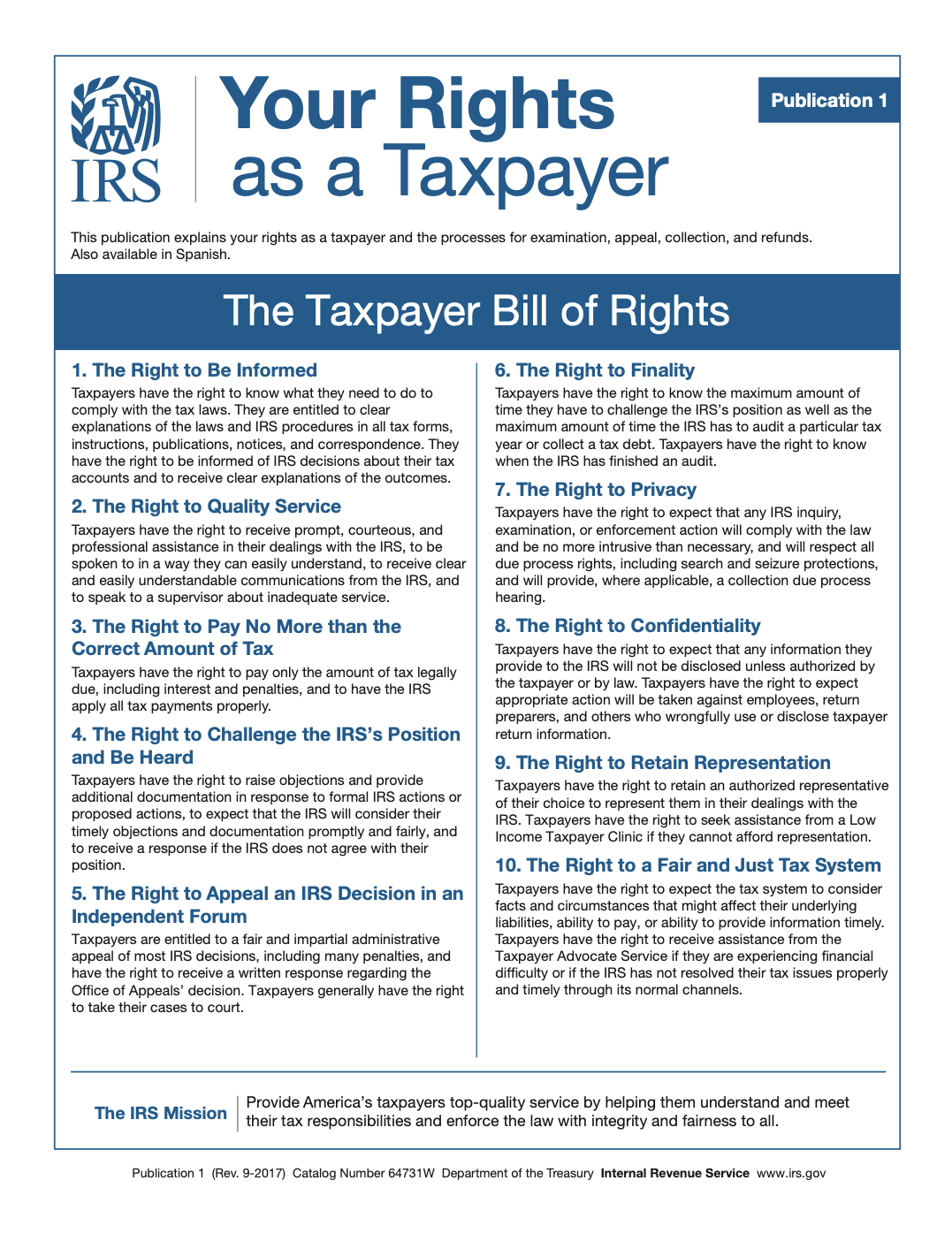

VITA is an IRS-certified program that offers free tax prep to taxpayers who qualify. VITA is a trusted source for preparing tax returns. All VITA volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards.

- Appointment needed for in-person tax preparation. The client will wait while the return is prepared and submitted to the IRS.

- No appointment needed for drop-off tax prep service. With drop-off, the intake and interview must be done in person but the return is prepared virtually. The client will be contacted via phone if the preparer has any questions. The client will bring their ID, SS# or ITIN, and tax documents to the VITA site, fill out the intake form, and complete the interview process. We then scan copies of the client’s tax forms. The client will need to sign the Virtual VITA Taxpayer Consent form in-person before leaving the VITA site. The taxpayer then comes back to the site for quality review and signing off on the completed tax return. The client has the option to do the quality review process via Zoom.

Have questions about the difference? Email vita@pimsavvy.com or call 206-565-2961, Option 4 or Option 2 (Spanish).

This year we have two VITA sites – Renton and Everett plus special events at libraries and community centers and other non-profit locations (in Seattle, Mukilteo and Kent). Use the calendar and table below to find your closest tax site at a time convenient for you.

INFORMATION ABOUT VITA/TCE FREE TAX PROGRAMS

DO I QUALIFY FOR VITA?

Find out if you qualify on the IRS website:

[ View Free Tax Preparation Qualifications ]

APPOINTMENTS:

Appointments usually last 1.5 to 2 hours per tax return.

We provide in-person tax prep and drop-off tax prep services.

Call Marc Matsui, 206-565-2961, Option 4 or email at vita@pimsavvy.com.

Call Vanessa Delgado, 206-565-2961, Option 2 or email at vita@pimsavvy.com.

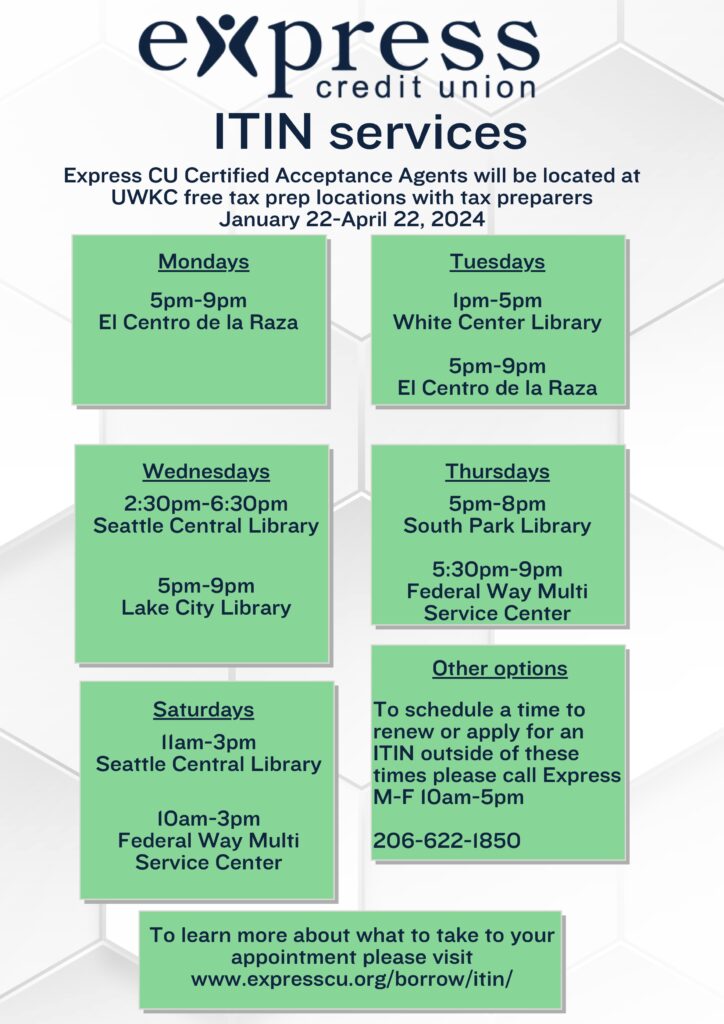

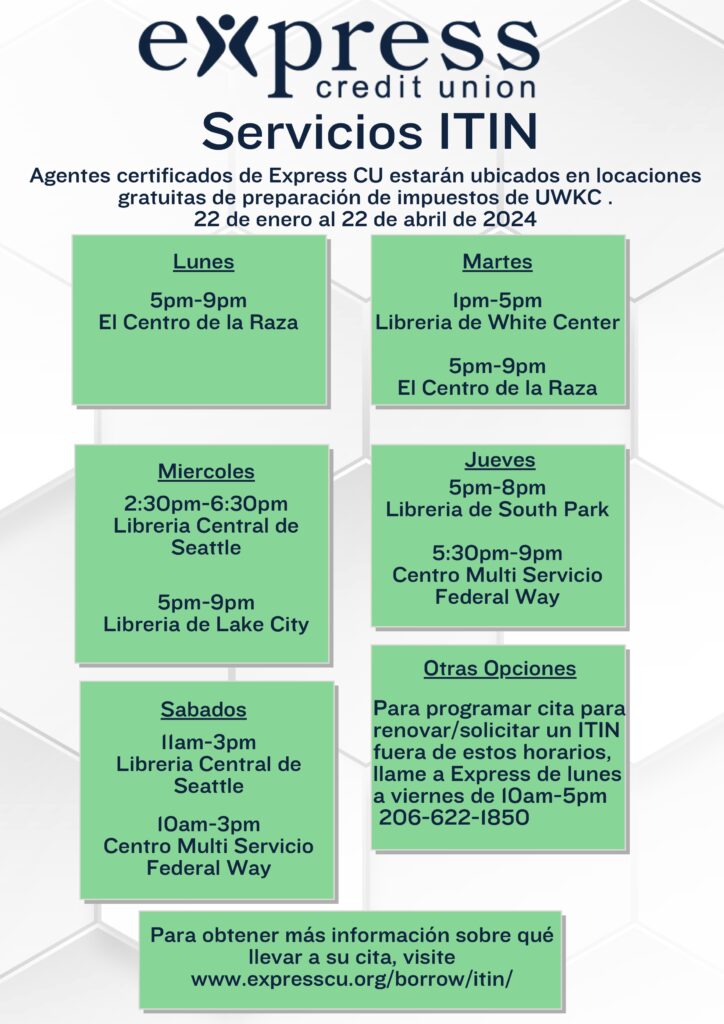

Individual Taxpayer Identification Number (ITIN)

Need help applying for or renewing your ITIN? Express Credit Union provides these services for free. Here are some events through April 22, 2024.

Renton Office

Our PIM Savvy Office in Renton

Our standard Renton office hours are:

9 am to 4 pm on Tuesdays beginning 1/23/24

9 am to 1 pm on Fridays beginning 1/26/24

Our Renton office location is:

707 S Grady Way, Suite 600

Renton, WA 98057

Everett Office

Our PIM Savvy Office in Everett at The Carl Gipson Center

Our standard Everett office hours are:

9 am to 3 pm on Mondays beginning 2/12/24

Our Everett office location is:

3025 Lombard Ave (Mt. Adams Room)

Everett, WA 98201

FIND OUT:

What types of income tax forms we can prepare

What we can’t prepare

What to bring to your appointment.

[ View or Download PDF ]

If you prefer to make your appointment by phone or text, dial 206-471-6017, or email vita@pimsavvy.com.

VITA Appointments

All Locations

April 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday April 1

1

|

Tuesday April 2

2

|

Wednesday April 3

3

|

Thursday April 4

4

|

Friday April 5

5

|

Saturday April 6

6

|

|

|

Sunday April 7

7

|

Monday April 8

8

|

Tuesday April 9

9

|

Wednesday April 10

10

|

Thursday April 11

11

|

Friday April 12

12

|

Saturday April 13

13

|

|

Sunday April 14

14

|

Monday April 15

15

|

Tuesday April 16

16

|

Wednesday April 17

17

|

Thursday April 18

18

|

Friday April 19

19

|

Saturday April 20

20

|

|

Sunday April 21

21

|

Monday April 22

22

|

Tuesday April 23

23

|

Wednesday April 24

24

|

Thursday April 25

25

|

Friday April 26

26

|

Saturday April 27

27

|

|

Sunday April 28

28

|

Monday April 29

29

|

Tuesday April 30

30

|

May 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday May 1

1

|

Thursday May 2

2

|

Friday May 3

3

|

Saturday May 4

4

|

|||

|

Sunday May 5

5

|

Monday May 6

6

|

Tuesday May 7

7

|

Wednesday May 8

8

|

Thursday May 9

9

|

Friday May 10

10

|

Saturday May 11

11

|

|

Sunday May 12

12

|

Monday May 13

13

|

Tuesday May 14

14

|

Wednesday May 15

15

|

Thursday May 16

16

|

Friday May 17

17

|

Saturday May 18

18

|

|

Sunday May 19

19

|

Monday May 20

20

|

Tuesday May 21

21

|

Wednesday May 22

22

|

Thursday May 23

23

|

Friday May 24

24

|

Saturday May 25

25

|

|

Sunday May 26

26

|

Monday May 27

27

|

Tuesday May 28

28

|

Wednesday May 29

29

|

Thursday May 30

30

|

Friday May 31

31

|

No events.

June 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday June 1

1

|

||||||

|

Sunday June 2

2

|

Monday June 3

3

|

Tuesday June 4

4

|

Wednesday June 5

5

|

Thursday June 6

6

|

Friday June 7

7

|

Saturday June 8

8

|

|

Sunday June 9

9

|

Monday June 10

10

|

Tuesday June 11

11

|

Wednesday June 12

12

|

Thursday June 13

13

|

Friday June 14

14

|

Saturday June 15

15

|

|

Sunday June 16

16

|

Monday June 17

17

|

Tuesday June 18

18

|

Wednesday June 19

19

|

Thursday June 20

20

|

Friday June 21

21

|

Saturday June 22

22

|

|

Sunday June 23

23

|

Monday June 24

24

|

Tuesday June 25

25

|

Wednesday June 26

26

|

Thursday June 27

27

|

Friday June 28

28

|

Saturday June 29

29

|

|

Sunday June 30

30

|

No events.

July 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday July 1

1

|

Tuesday July 2

2

|

Wednesday July 3

3

|

Thursday July 4

4

|

Friday July 5

5

|

Saturday July 6

6

|

|

|

Sunday July 7

7

|

Monday July 8

8

|

Tuesday July 9

9

|

Wednesday July 10

10

|

Thursday July 11

11

|

Friday July 12

12

|

Saturday July 13

13

|

|

Sunday July 14

14

|

Monday July 15

15

|

Tuesday July 16

16

|

Wednesday July 17

17

|

Thursday July 18

18

|

Friday July 19

19

|

Saturday July 20

20

|

|

Sunday July 21

21

|

Monday July 22

22

|

Tuesday July 23

23

|

Wednesday July 24

24

|

Thursday July 25

25

|

Friday July 26

26

|

Saturday July 27

27

|

|

Sunday July 28

28

|

Monday July 29

29

|

Tuesday July 30

30

|

Wednesday July 31

31

|

No events.

August 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Thursday August 1

1

|

Friday August 2

2

|

Saturday August 3

3

|

||||

|

Sunday August 4

4

|

Monday August 5

5

|

Tuesday August 6

6

|

Wednesday August 7

7

|

Thursday August 8

8

|

Friday August 9

9

|

Saturday August 10

10

|

|

Sunday August 11

11

|

Monday August 12

12

|

Tuesday August 13

13

|

Wednesday August 14

14

|

Thursday August 15

15

|

Friday August 16

16

|

Saturday August 17

17

|

|

Sunday August 18

18

|

Monday August 19

19

|

Tuesday August 20

20

|

Wednesday August 21

21

|

Thursday August 22

22

|

Friday August 23

23

|

Saturday August 24

24

|

|

Sunday August 25

25

|

Monday August 26

26

|

Tuesday August 27

27

|

Wednesday August 28

28

|

Thursday August 29

29

|

Friday August 30

30

|

Saturday August 31

31

|

No events.

September 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday September 1

1

|

Monday September 2

2

|

Tuesday September 3

3

|

Wednesday September 4

4

|

Thursday September 5

5

|

Friday September 6

6

|

Saturday September 7

7

|

|

Sunday September 8

8

|

Monday September 9

9

|

Tuesday September 10

10

|

Wednesday September 11

11

|

Thursday September 12

12

|

Friday September 13

13

|

Saturday September 14

14

|

|

Sunday September 15

15

|

Monday September 16

16

|

Tuesday September 17

17

|

Wednesday September 18

18

|

Thursday September 19

19

|

Friday September 20

20

|

Saturday September 21

21

|

|

Sunday September 22

22

|

Monday September 23

23

|

Tuesday September 24

24

|

Wednesday September 25

25

|

Thursday September 26

26

|

Friday September 27

27

|

Saturday September 28

28

|

|

Sunday September 29

29

|

Monday September 30

30

|

No events.

October 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Tuesday October 1

1

|

Wednesday October 2

2

|

Thursday October 3

3

|

Friday October 4

4

|

Saturday October 5

5

|

||

|

Sunday October 6

6

|

Monday October 7

7

|

Tuesday October 8

8

|

Wednesday October 9

9

|

Thursday October 10

10

|

Friday October 11

11

|

Saturday October 12

12

|

|

Sunday October 13

13

|

Monday October 14

14

|

Tuesday October 15

15

|

Wednesday October 16

16

|

Thursday October 17

17

|

Friday October 18

18

|

Saturday October 19

19

|

|

Sunday October 20

20

|

Monday October 21

21

|

Tuesday October 22

22

|

Wednesday October 23

23

|

Thursday October 24

24

|

Friday October 25

25

|

Saturday October 26

26

|

|

Sunday October 27

27

|

Monday October 28

28

|

Tuesday October 29

29

|

Wednesday October 30

30

|

Thursday October 31

31

|

No events.

November 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Friday November 1

1

|

Saturday November 2

2

|

|||||

|

Sunday November 3

3

|

Monday November 4

4

|

Tuesday November 5

5

|

Wednesday November 6

6

|

Thursday November 7

7

|

Friday November 8

8

|

Saturday November 9

9

|

|

Sunday November 10

10

|

Monday November 11

11

|

Tuesday November 12

12

|

Wednesday November 13

13

|

Thursday November 14

14

|

Friday November 15

15

|

Saturday November 16

16

|

|

Sunday November 17

17

|

Monday November 18

18

|

Tuesday November 19

19

|

Wednesday November 20

20

|

Thursday November 21

21

|

Friday November 22

22

|

Saturday November 23

23

|

|

Sunday November 24

24

|

Monday November 25

25

|

Tuesday November 26

26

|

Wednesday November 27

27

|

Thursday November 28

28

|

Friday November 29

29

|

Saturday November 30

30

|

No events.

December 2024

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday December 1

1

|

Monday December 2

2

|

Tuesday December 3

3

|

Wednesday December 4

4

|

Thursday December 5

5

|

Friday December 6

6

|

Saturday December 7

7

|

|

Sunday December 8

8

|

Monday December 9

9

|

Tuesday December 10

10

|

Wednesday December 11

11

|

Thursday December 12

12

|

Friday December 13

13

|

Saturday December 14

14

|

|

Sunday December 15

15

|

Monday December 16

16

|

Tuesday December 17

17

|

Wednesday December 18

18

|

Thursday December 19

19

|

Friday December 20

20

|

Saturday December 21

21

|

|

Sunday December 22

22

|

Monday December 23

23

|

Tuesday December 24

24

|

Wednesday December 25

25

|

Thursday December 26

26

|

Friday December 27

27

|

Saturday December 28

28

|

|

Sunday December 29

29

|

Monday December 30

30

|

Tuesday December 31

31

|

No events.

January 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday January 1

1

|

Thursday January 2

2

|

Friday January 3

3

|

Saturday January 4

4

|

|||

|

Sunday January 5

5

|

Monday January 6

6

|

Tuesday January 7

7

|

Wednesday January 8

8

|

Thursday January 9

9

|

Friday January 10

10

|

Saturday January 11

11

|

|

Sunday January 12

12

|

Monday January 13

13

|

Tuesday January 14

14

|

Wednesday January 15

15

|

Thursday January 16

16

|

Friday January 17

17

|

Saturday January 18

18

|

|

Sunday January 19

19

|

Monday January 20

20

|

Tuesday January 21

21

|

Wednesday January 22

22

|

Thursday January 23

23

|

Friday January 24

24

|

Saturday January 25

25

|

|

Sunday January 26

26

|

Monday January 27

27

|

Tuesday January 28

28

|

Wednesday January 29

29

|

Thursday January 30

30

|

Friday January 31

31

|

No events.

February 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday February 1

1

|

||||||

|

Sunday February 2

2

|

Monday February 3

3

|

Tuesday February 4

4

|

Wednesday February 5

5

|

Thursday February 6

6

|

Friday February 7

7

|

Saturday February 8

8

|

|

Sunday February 9

9

|

Monday February 10

10

|

Tuesday February 11

11

|

Wednesday February 12

12

|

Thursday February 13

13

|

Friday February 14

14

|

Saturday February 15

15

|

|

Sunday February 16

16

|

Monday February 17

17

|

Tuesday February 18

18

|

Wednesday February 19

19

|

Thursday February 20

20

|

Friday February 21

21

|

Saturday February 22

22

|

|

Sunday February 23

23

|

Monday February 24

24

|

Tuesday February 25

25

|

Wednesday February 26

26

|

Thursday February 27

27

|

Friday February 28

28

|

No events.

March 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday March 1

1

|

||||||

|

Sunday March 2

2

|

Monday March 3

3

|

Tuesday March 4

4

|

Wednesday March 5

5

|

Thursday March 6

6

|

Friday March 7

7

|

Saturday March 8

8

|

|

Sunday March 9

9

|

Monday March 10

10

|

Tuesday March 11

11

|

Wednesday March 12

12

|

Thursday March 13

13

|

Friday March 14

14

|

Saturday March 15

15

|

|

Sunday March 16

16

|

Monday March 17

17

|

Tuesday March 18

18

|

Wednesday March 19

19

|

Thursday March 20

20

|

Friday March 21

21

|

Saturday March 22

22

|

|

Sunday March 23

23

|

Monday March 24

24

|

Tuesday March 25

25

|

Wednesday March 26

26

|

Thursday March 27

27

|

Friday March 28

28

|

Saturday March 29

29

|

|

Sunday March 30

30

|

Monday March 31

31

|

No events.

April 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Tuesday April 1

1

|

Wednesday April 2

2

|

Thursday April 3

3

|

Friday April 4

4

|

Saturday April 5

5

|

||

|

Sunday April 6

6

|

Monday April 7

7

|

Tuesday April 8

8

|

Wednesday April 9

9

|

Thursday April 10

10

|

Friday April 11

11

|

Saturday April 12

12

|

|

Sunday April 13

13

|

Monday April 14

14

|

Tuesday April 15

15

|

Wednesday April 16

16

|

Thursday April 17

17

|

Friday April 18

18

|

Saturday April 19

19

|

|

Sunday April 20

20

|

Monday April 21

21

|

Tuesday April 22

22

|

Wednesday April 23

23

|

Thursday April 24

24

|

Friday April 25

25

|

Saturday April 26

26

|

|

Sunday April 27

27

|

Monday April 28

28

|

Tuesday April 29

29

|

Wednesday April 30

30

|

No events.

May 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Thursday May 1

1

|

Friday May 2

2

|

Saturday May 3

3

|

||||

|

Sunday May 4

4

|

Monday May 5

5

|

Tuesday May 6

6

|

Wednesday May 7

7

|

Thursday May 8

8

|

Friday May 9

9

|

Saturday May 10

10

|

|

Sunday May 11

11

|

Monday May 12

12

|

Tuesday May 13

13

|

Wednesday May 14

14

|

Thursday May 15

15

|

Friday May 16

16

|

Saturday May 17

17

|

|

Sunday May 18

18

|

Monday May 19

19

|

Tuesday May 20

20

|

Wednesday May 21

21

|

Thursday May 22

22

|

Friday May 23

23

|

Saturday May 24

24

|

|

Sunday May 25

25

|

Monday May 26

26

|

Tuesday May 27

27

|

Wednesday May 28

28

|

Thursday May 29

29

|

Friday May 30

30

|

Saturday May 31

31

|

No events.

June 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday June 1

1

|

Monday June 2

2

|

Tuesday June 3

3

|

Wednesday June 4

4

|

Thursday June 5

5

|

Friday June 6

6

|

Saturday June 7

7

|

|

Sunday June 8

8

|

Monday June 9

9

|

Tuesday June 10

10

|

Wednesday June 11

11

|

Thursday June 12

12

|

Friday June 13

13

|

Saturday June 14

14

|

|

Sunday June 15

15

|

Monday June 16

16

|

Tuesday June 17

17

|

Wednesday June 18

18

|

Thursday June 19

19

|

Friday June 20

20

|

Saturday June 21

21

|

|

Sunday June 22

22

|

Monday June 23

23

|

Tuesday June 24

24

|

Wednesday June 25

25

|

Thursday June 26

26

|

Friday June 27

27

|

Saturday June 28

28

|

|

Sunday June 29

29

|

Monday June 30

30

|

No events.

VITA Special Events

IN-PERSON or DROP-OFF TAX PREPARATION SERVICES AVAILABLE.

Note: Appointments are needed for in-person tax preparation.

| Saturday, February 3 10:30 am – 4:30 pm | Mukilteo Library | 4675 Harbour Pointe Blvd, Mukilteo, WA 98275 | Appointments |

| Saturday, February 10 8:30 am – 5:30 pm | Kabul Washington Association | 1209 Central Ave S suite 140, Kent, WA 98032 | Appointments |

| Saturday, February 17 8:30 am – 5:30 pm | Kabul Washington Association | 1209 Central Ave S suite 140, Kent, WA 98032 | Appointments |

| Wednesday, February 28 10:00 am – 6:00 pm | YWCA Greenbridge Learning Center | 9720 8th Ave SW, Seattle, WA 98106 | Appointments |

| Wednesday, March 6 10:00 am – 6:00 pm | YWCA Greenbridge Learning Center | 9720 8th Ave SW, Seattle, WA 98106 | Appointments |

| Saturday, March 9 9:00 am – 4:00 pm | YWCA Greenbridge Learning Center | 9720 8th Ave SW, Seattle, WA 98106 | Appointments |

| Wednesday, March 13 2:00 pm – 6:30 pm | Mukilteo Library | 4675 Harbour Pointe Blvd, Mukilteo, WA 98275 | Appointments |

| Wednesday, March 20 12:30 pm – 7:00 pm | Seattle Public Library, Rainier Beach Branch | 9125 Rainier Ave S, Seattle, WA 98118 | Appointments |

| Saturday, March 23 10:30 am – 4:30 pm | Mukilteo Library | 4675 Harbour Pointe Blvd, Mukilteo, WA 98275 | Appointments |

| Wednesday, March 27 2:00 pm – 6:30 pm | Mukilteo Library | 4675 Harbour Pointe Blvd, Mukilteo, WA 98275 | Appointments |

| Saturday, March 30 11:30 am – 5:00 pm | Federal Way Library | 34200 1st Way S, Federal Way, WA 98003, Meeting Room 2 | Appointments |

| Wednesday, April 3 12:30 pm – 7:00 pm | Seattle Public Library, Rainier Beach Branch | 9125 Rainier Ave S, Seattle, WA 98118 | Appointments |

| Saturday, April 6 10:30 am – 4:30 pm | Mukilteo Library | 4675 Harbour Pointe Blvd, Mukilteo, WA 98275 | Appointments |

INFORMATION ABOUT VITA/TCE FREE TAX PROGRAMS

DO I QUALIFY FOR VITA?

Find out if you qualify on the IRS website:

[ View Free Tax Preparation Qualifications ]

APPOINTMENTS:

Appointments usually last 1.5 to 2 hours per tax return.

We provide in-person tax prep and drop-off tax prep services.

Call Marc Matsui, 206-565-2961, Option 4 or email at vita@pimsavvy.com.

Call Vanessa Delgado, 206-565-2961, Option 2 or email at vita@pimsavvy.com.

Individual Taxpayer Identification Number (ITIN)

Need help applying for or renewing your ITIN? Express Credit Union provides these services for free. Here are some events through April 22, 2024.