Working Families Tax Credit

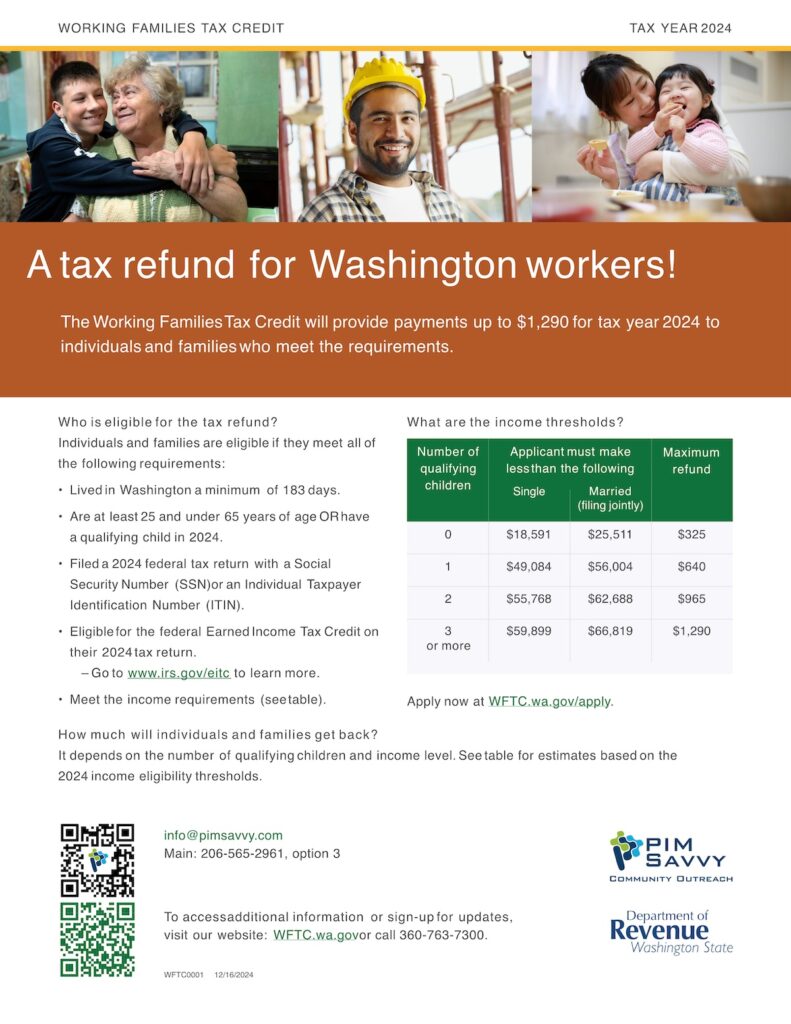

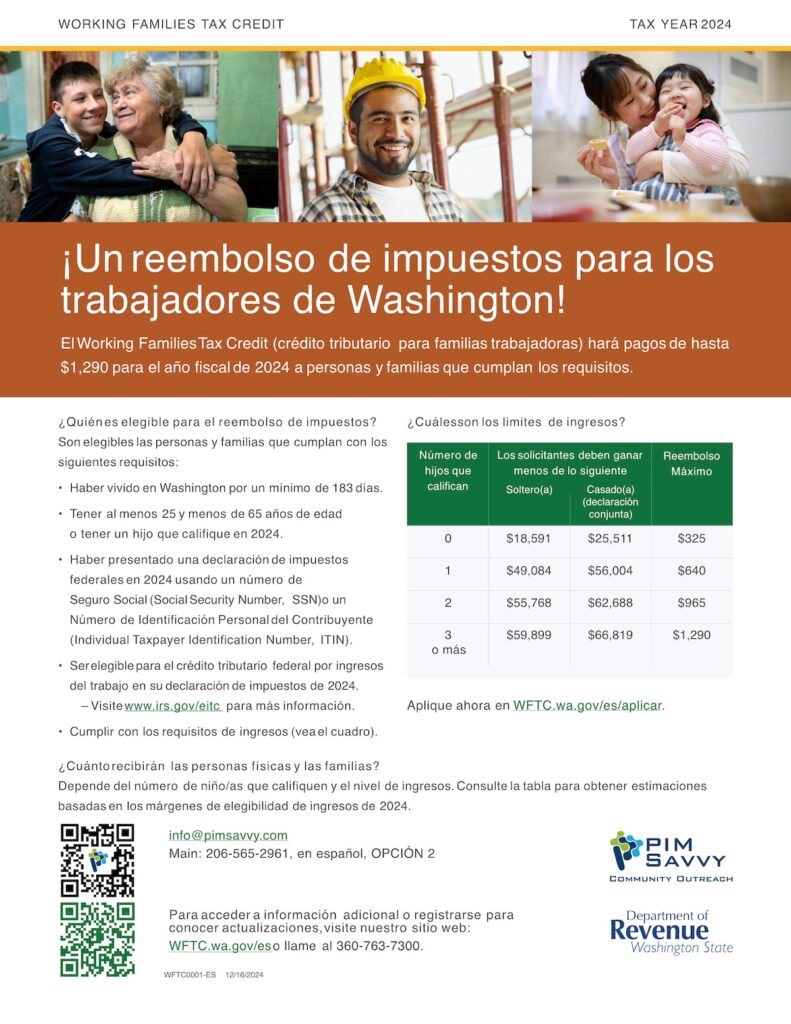

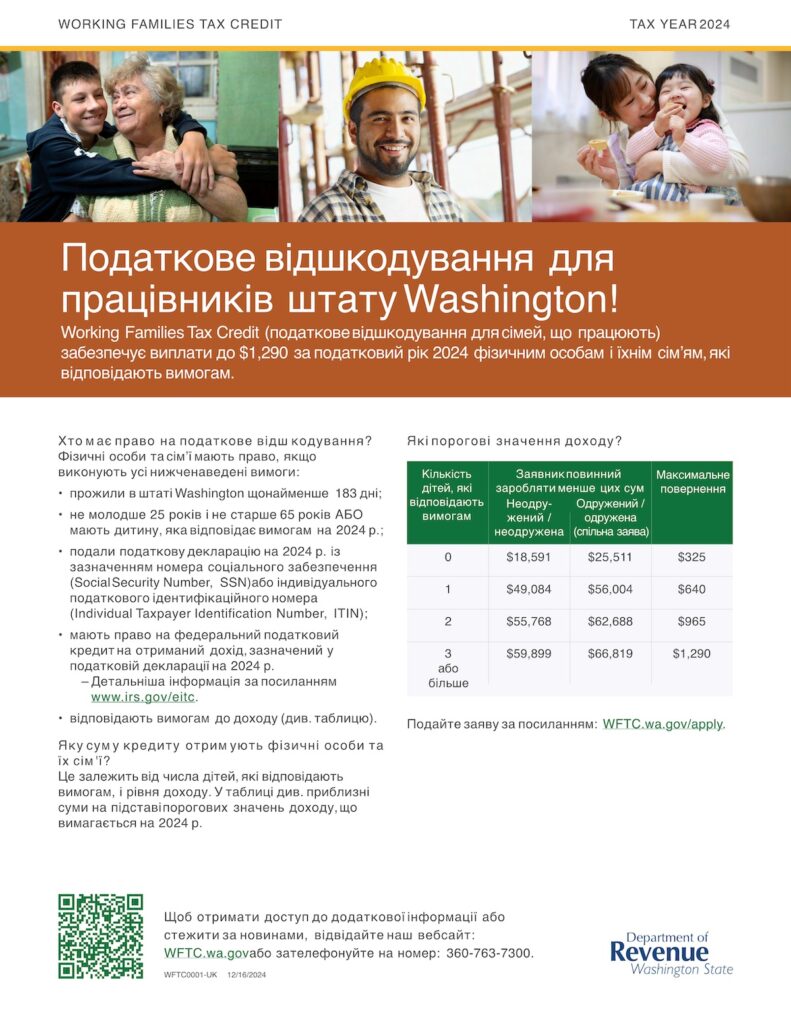

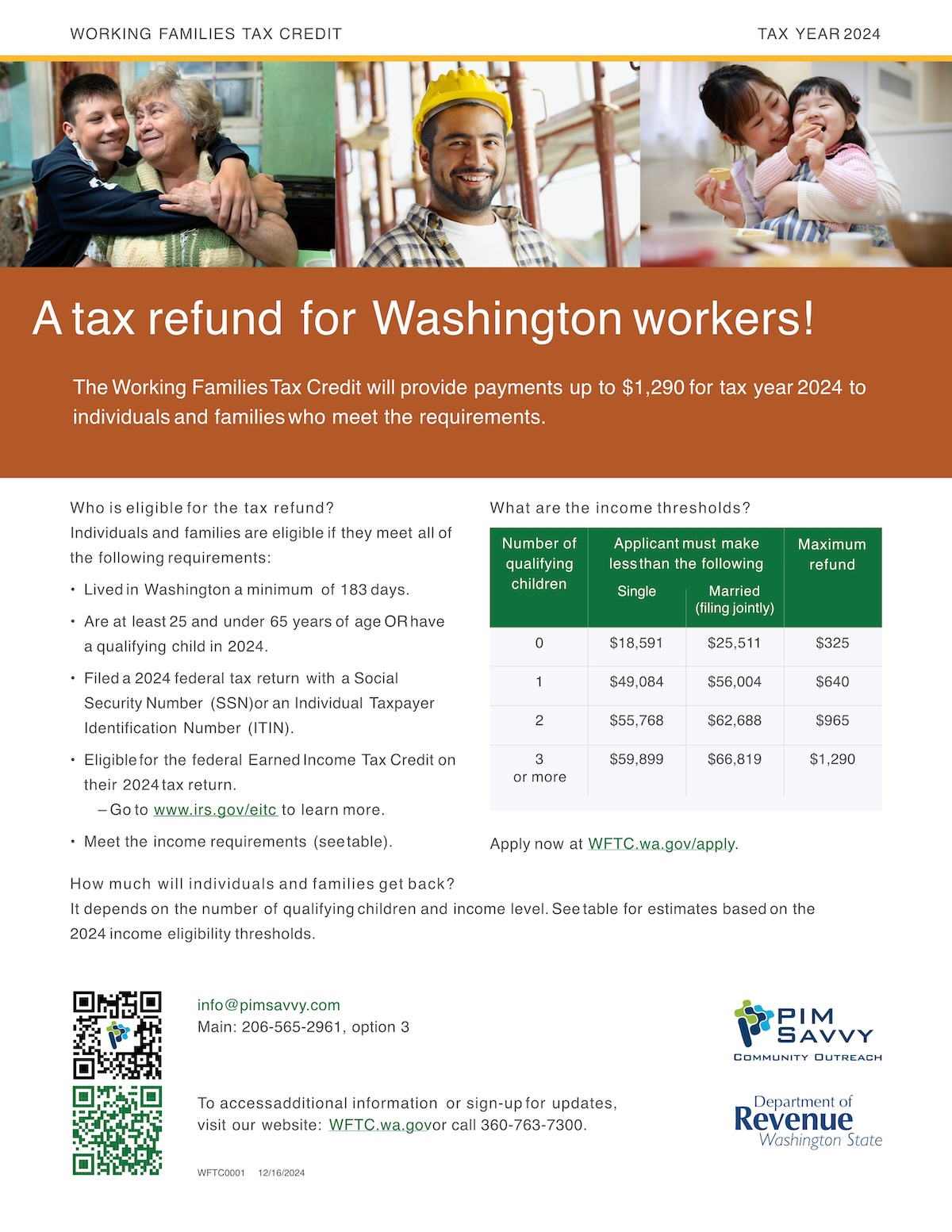

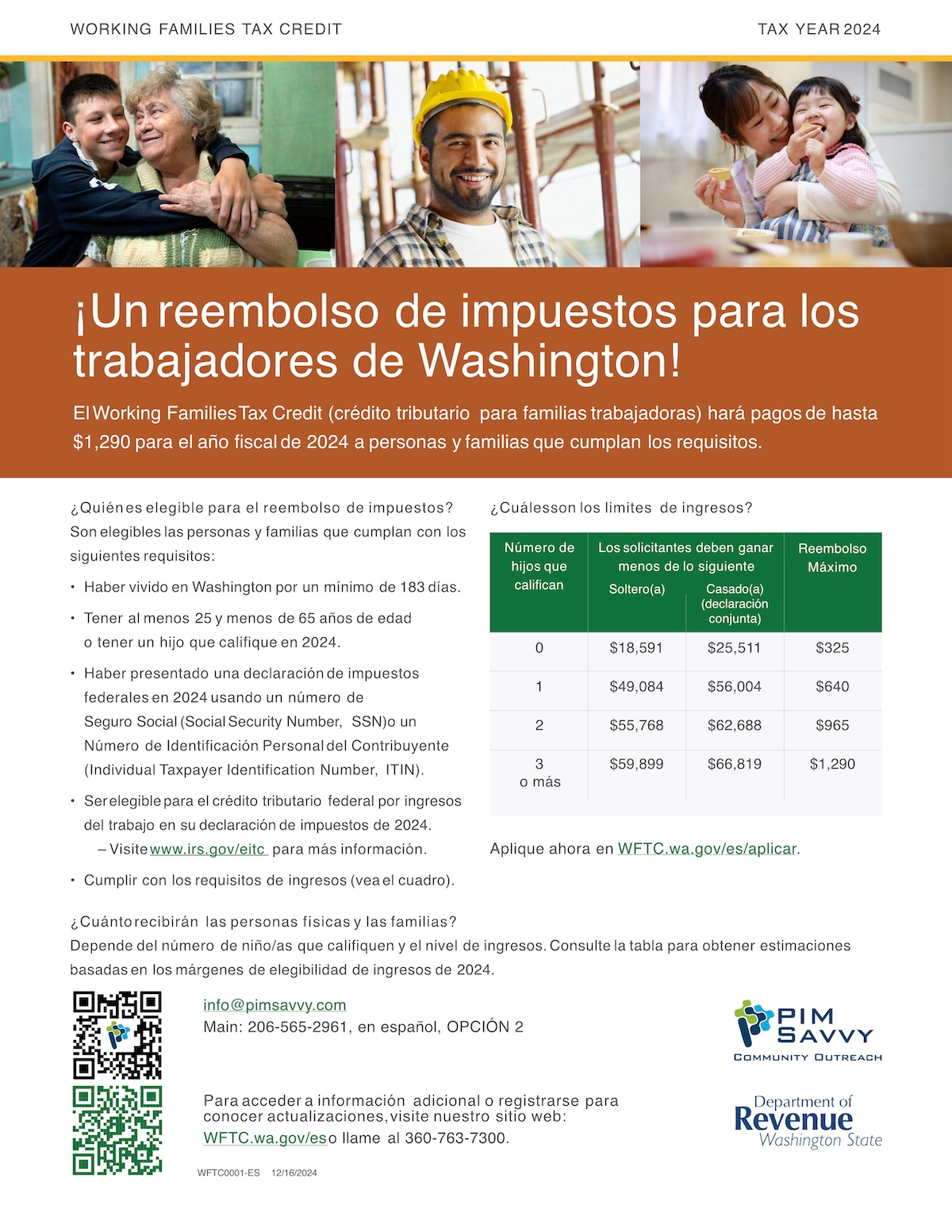

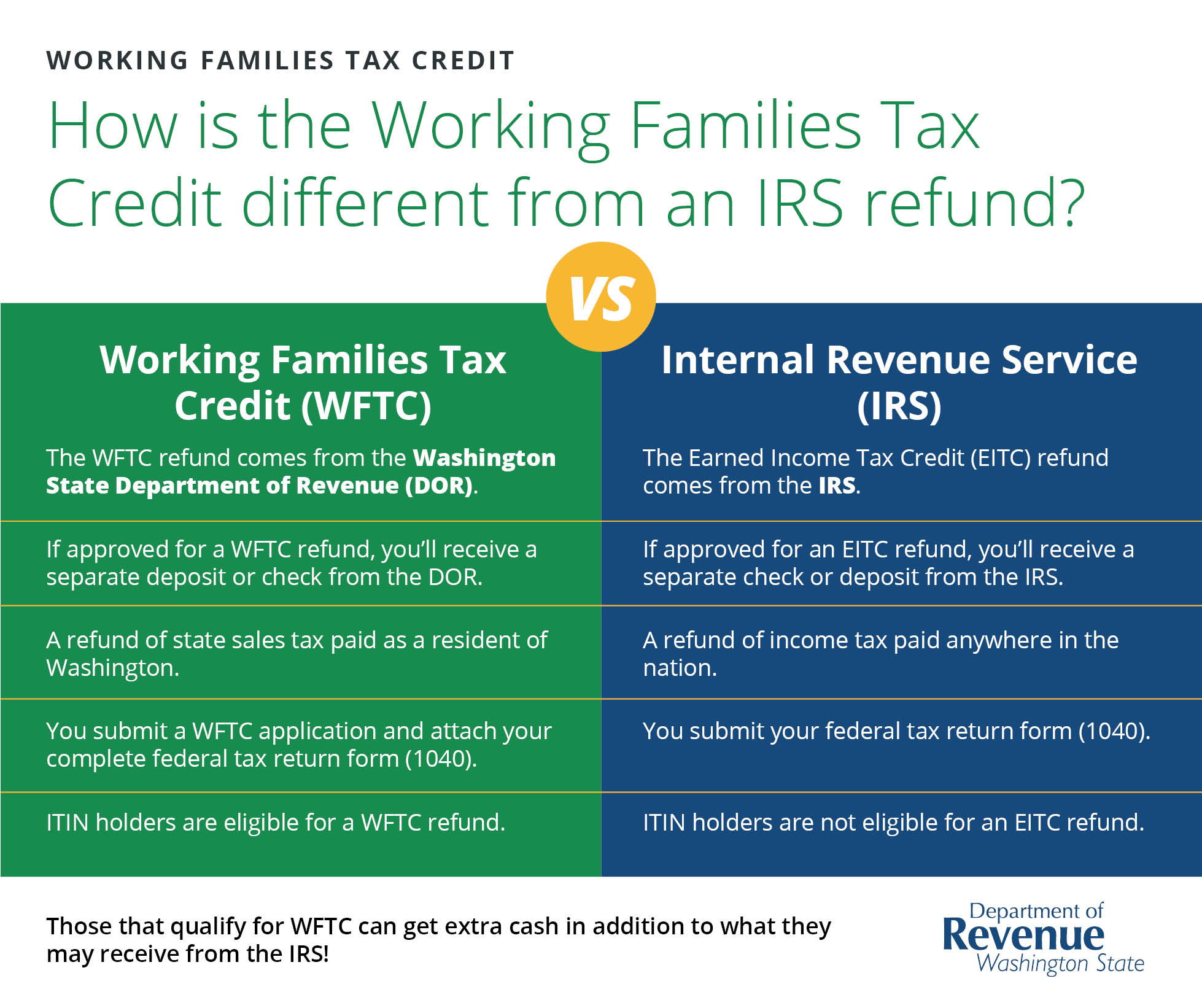

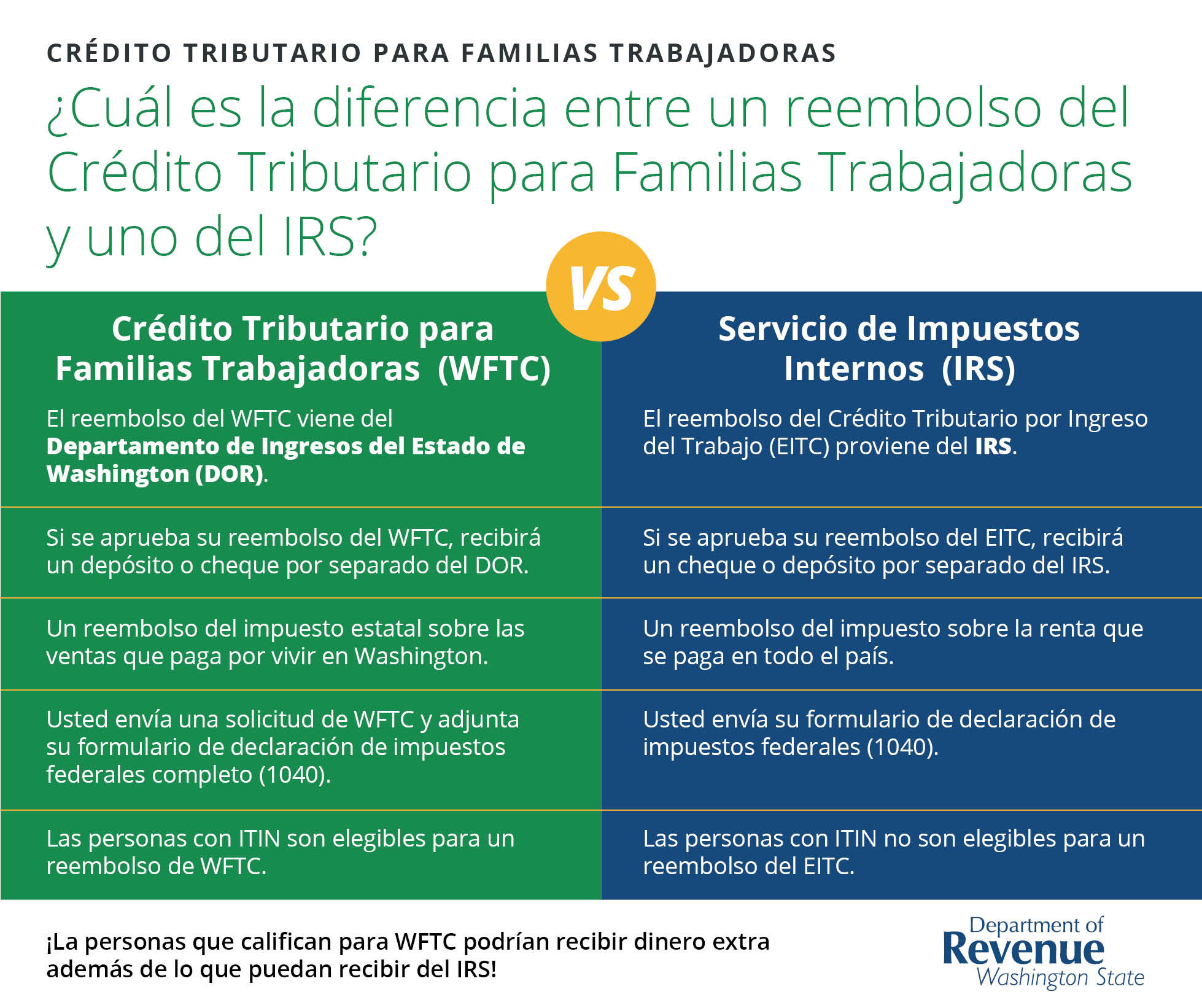

Eligible individuals and families can receive the Working Families Tax Credit – a tax refund up to $1,290 for Washington workers.

Do you have questions about eligibility or need help applying? Call or text our Working Families Tax Credit phone line at 206-565-2961, Option 3.

Working Families Tax Credit applications for 2024 will open on February 1, 2025

To read more about the Washington’s Working Families Tax Credit, visit WFTC.wa.gov.

The Washington State Department of Revenue has chosen PIM Savvy Inc. to provide FREE Working Families Tax Credit outreach/application help and Volunteer Income Tax Assistance (VITA) services related to the Working Families Tax Credit program.

To read more about the work PIM Savvy is doing, please click here

Program Questions? Contact a tax outreach coordinator at vita@pimsavvy.com or 206-565-2961, option 3.

On This Page

Working Families Tax Credit

Call or Text PIM Savvy, 206.565.2961, Option 3.

info@pimsavvy.com

Subscribe now to keep informed about the Working Families Tax Credit and PIM Savvy’s other programs and services.

Informational Videos

Information about the Working Families Tax Credit from WA State Department of Revenue

Who Should Apply for the Working Families Tax Credit in 2023?

You + Working Families Tax Credit

Questions about eligibility for the Working Families Tax Credit

WA State Department of Revenue Information Video – English

WA State Department of Revenue Information Video – Spanish

About the Washington State Department of Commerce

The Department of Commerce is the one agency in state government that touches every aspect of community and economic development: planning, infrastructure, energy, public facilities, housing, public safety and crime victims, international trade, business services and more. Commerce works with local governments, tribes, businesses, and civic leaders throughout Washington state to strengthen communities and grow local economies so all residents may thrive and prosper.

More information about Commerce can be found here.

Resources

Blog

Missed the April 15th Tax-Filing Due Date? File Promptly to Minimize Interest and Penalties

The Internal Revenue Service encourages taxpayers who missed the filing deadline to submit their tax return as soon as possible. Those who missed the deadline to file but owe taxes should file timely to avoid additional penalties and interest.

Gig Economy & PIM Savvy VITA Services

You must file a tax return if you have net earnings from self-employment of $400 or more from gig work. PIM Savvy’s Volunteer Income Tax Assistance (VITA) site can help you file your taxes for FREE if you qualify.

PIM Savvy CAA and ITIN Services

PIM Savvy VITA now offers Certifying Acceptance Agent (CAA) services to individuals and families in Washington State! We partnered with the Internal Revenue Service (IRS) so we can assist alien individuals and other foreign persons obtain Individual Taxpayer Identification Numbers (ITIN).

Saver’s Credit

You may be able to take a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan. Also, you may be eligible for a credit for contributions to your Achieving a Better Life Experience (ABLE) account, if you’re the designated beneficiary.

PIM Savvy VITA Virtual Tax Preparation

PIM Savvy VITA now offers Virtual Tax Preparation services in partnership with the Internal Revenue Service (IRS).

Earned Income Tax Credit Awareness Day

The 19th annual EITC Awareness Day marks the kick-off of a nationwide multilingual communication effort intended to increase awareness of EITC eligibility, encourage participation, and emphasize the filing of accurate returns.