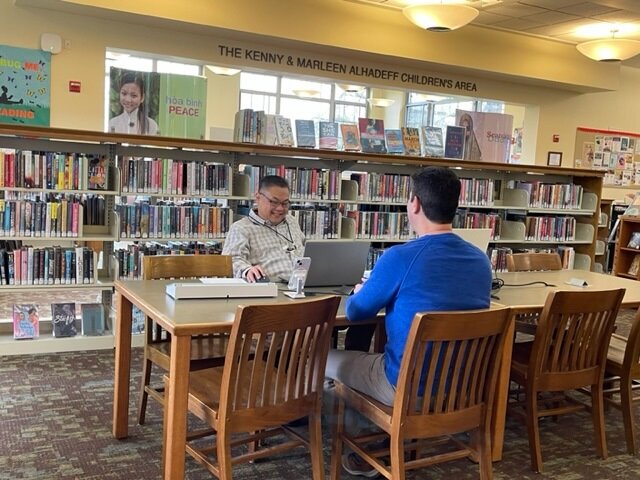

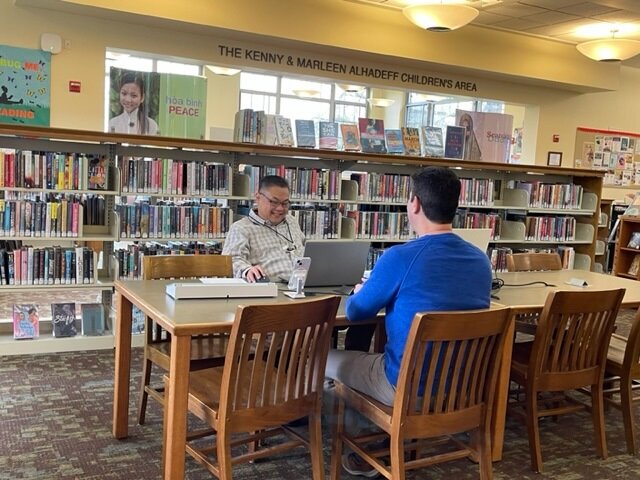

PIM Savvy's Free Tax Prep (VITA) Program

In partnership with the Washington State Department of Revenue and the Internal Revenue Service (IRS), PIM Savvy provides FREE IN-PERSON TAX PREPARATION throughout King and Snohomish Counties in Washington State. We also offer VIRTUAL TAX PREPARATION for all WA residents who qualify for VITA. We ensure taxpayers maximize their refunds by claiming all credits they are eligible for, including the federal Earned Income Tax Credit (EITC) and Washington State’s Working Families Tax Credit (WFTC).

Book early because appointments will fill up quickly!

VITA is an IRS-certified program that offers free tax prep to taxpayers who qualify. VITA is a trusted source for preparing tax returns. All VITA volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards.

100% virtual tax prep and convenient! Upload your tax documents through a secure platform. An IRS-certified VITA volunteer will review your documents and contact you for additional information. Then meet virtually with an IRS-certified tax preparer volunteer through a virtual meeting. Your tax return will be sent back to you for review, and you will meet with a different tax preparer to review it, before it is filed electronically with the IRS.

IRS Direct File allows taxpayers to prepare and file their taxes online – for free – directly with the IRS. Direct File is simple, accurate and secure. This is another option especially if you are short on time for an in-person appointment.

Eligible taxpayers can use IRS Direct File to file their tax returns online with the IRS for FREE! No third party needed. The IRS estimates 920,000 Washington residents are eligible to use Direct File. Find out if you qualify for Direct File today by going to directfile.irs.gov.

In 2025, PIM Savvy will have four (4) VITA sites – Two in Renton and two in Everett plus special events at libraries and community centers and other non-profit locations (in Federal Way, Kent, Bellevue, Mukilteo, and Everett). Use the calendar and table below to find your closest tax site at a time convenient for you.

INFORMATION ABOUT VITA/TCE FREE TAX PROGRAMS

DO I QUALIFY FOR VITA?

Find out if you qualify on the IRS website:

[ View Free Tax Preparation Qualifications ]

APPOINTMENTS:

Appointments usually last 1.5 to 2 hours per tax return.

We provide in-person tax prep and 100% virtual services.

Call Aimee Jimenez, 206-565-2961, Option 4 or email at vita@pimsavvy.com.

Call Vanessa Delgado, 206-565-2961, Option 2 or email at vita@pimsavvy.com.

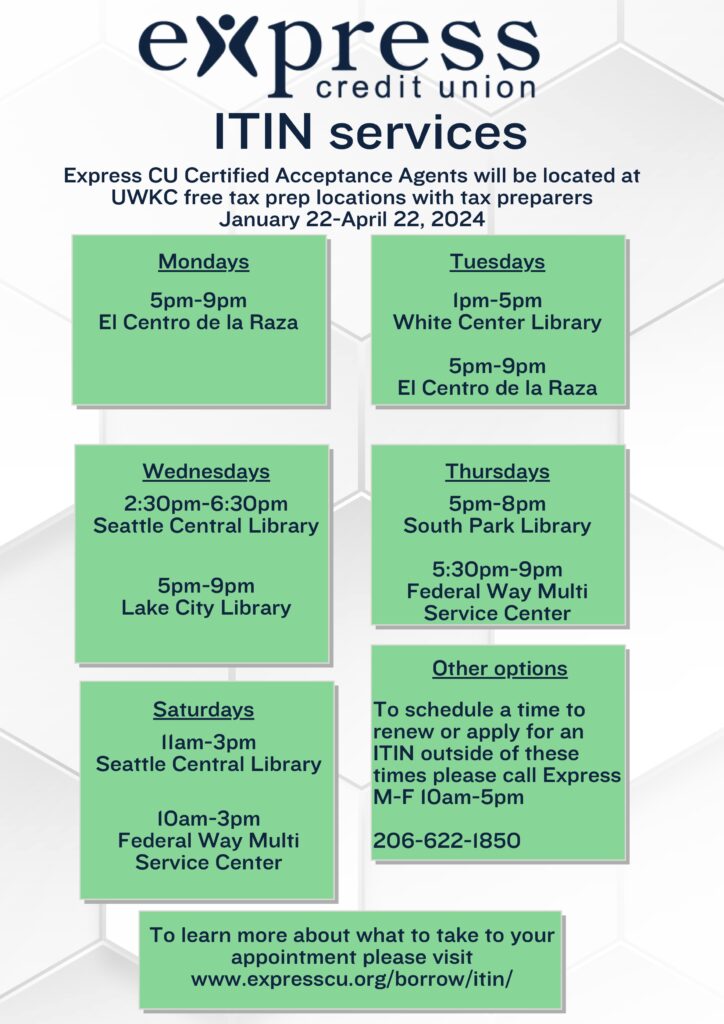

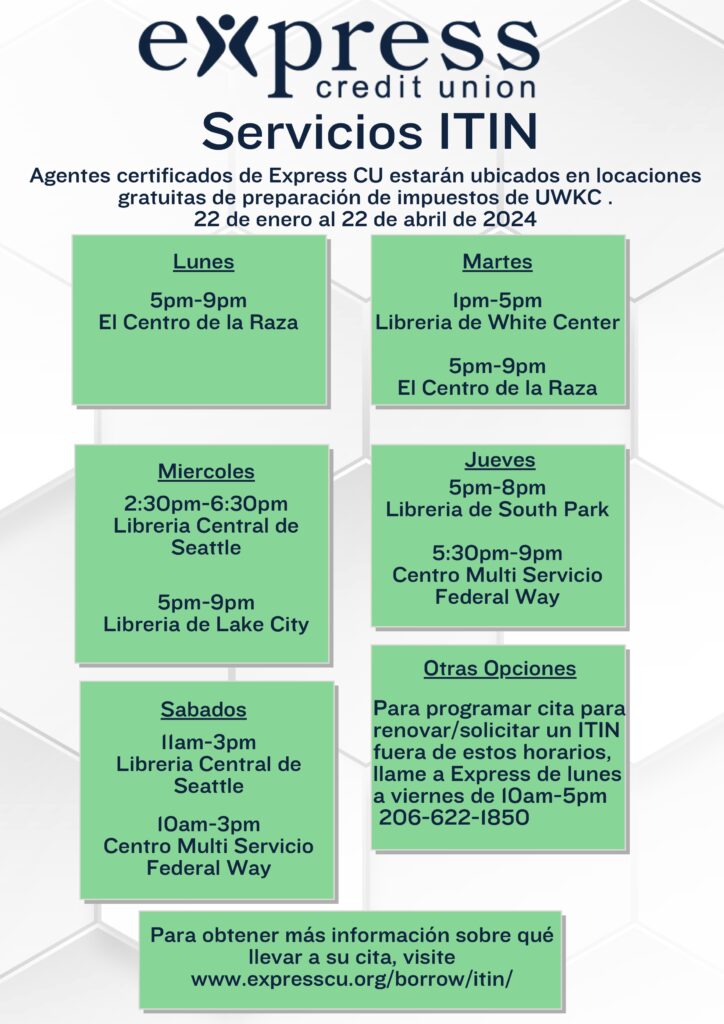

Individual Taxpayer Identification Number (ITIN)

Need help applying for or renewing your ITIN, too? PIM Savvy also provides these services for FREE.

All ITIN services are by appointment only.

Comuníquese con nosotros hoy mismo.

Los servicios de ITIN y VITA (Programa Gratuito de Preparación de Impuestos) se realizan únicamente con cita previa.

PIM Savvy VITA

Carl Gipson Center VITA Site

Location

3025 Lombard Ave

Everett, WA, 98201 (Alcove Room)

The Village on Casino Road VITA Site

Location

14 E Casino Rd

Everett, WA 98208

ITIN Application/Reactivation Services

Location

707 S Grady Way, Suite 600

Renton, WA 98057

All ITIN services are by appointment only.

Virtual Tax Prep

Virtual tax prep or in-person for ITIN applications.

Note: Virtual tax preparation services will open again on 4/28/25. Please check back then.

Free ITIN Application/Reactivation Services

Location

707 S Grady Way, Suite 600

Renton, WA 98057

FIND OUT:

What types of income tax forms we can prepare

What we can’t prepare

What to bring to your appointment.

[ View or Download PDF ]

If you prefer to make your appointment by phone or text, dial 206-471-6017, or email vita@pimsavvy.com.

No Appointment Needed for Working Families Tax Credit Application Help

VITA Appointments

All Locations

June 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday June 1

1

|

Monday June 2

2

|

Tuesday June 3

3

|

Wednesday June 4

4

|

Thursday June 5

5

|

Friday June 6

6

|

Saturday June 7

7

|

|

Sunday June 8

8

|

Monday June 9

9

|

Tuesday June 10

10

|

Wednesday June 11

11

|

Thursday June 12

12

|

Friday June 13

13

|

Saturday June 14

14

|

|

Sunday June 15

15

|

Monday June 16

16

|

Tuesday June 17

17

|

Wednesday June 18

18

|

Thursday June 19

19

|

Friday June 20

20

|

Saturday June 21

21

|

|

Sunday June 22

22

|

Monday June 23

23

|

Tuesday June 24

24

|

Wednesday June 25

25

|

Thursday June 26

26

|

Friday June 27

27

|

Saturday June 28

28

|

|

Sunday June 29

29

|

Monday June 30

30

|

July 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Tuesday July 1

1

|

Wednesday July 2

2

|

Thursday July 3

3

|

Friday July 4

4

|

Saturday July 5

5

|

||

|

Sunday July 6

6

|

Monday July 7

7

|

Tuesday July 8

8

|

Wednesday July 9

9

|

Thursday July 10

10

|

Friday July 11

11

|

Saturday July 12

12

|

|

Sunday July 13

13

|

Monday July 14

14

|

Tuesday July 15

15

|

Wednesday July 16

16

|

Thursday July 17

17

|

Friday July 18

18

|

Saturday July 19

19

|

|

Sunday July 20

20

|

Monday July 21

21

|

Tuesday July 22

22

|

Wednesday July 23

23

|

Thursday July 24

24

|

Friday July 25

25

|

Saturday July 26

26

|

|

Sunday July 27

27

|

Monday July 28

28

|

Tuesday July 29

29

|

Wednesday July 30

30

|

Thursday July 31

31

|

No events.

August 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Friday August 1

1

|

Saturday August 2

2

|

|||||

|

Sunday August 3

3

|

Monday August 4

4

|

Tuesday August 5

5

|

Wednesday August 6

6

|

Thursday August 7

7

|

Friday August 8

8

|

Saturday August 9

9

|

|

Sunday August 10

10

|

Monday August 11

11

|

Tuesday August 12

12

|

Wednesday August 13

13

|

Thursday August 14

14

|

Friday August 15

15

|

Saturday August 16

16

|

|

Sunday August 17

17

|

Monday August 18

18

|

Tuesday August 19

19

|

Wednesday August 20

20

|

Thursday August 21

21

|

Friday August 22

22

|

Saturday August 23

23

|

|

Sunday August 24

24

|

Monday August 25

25

|

Tuesday August 26

26

|

Wednesday August 27

27

|

Thursday August 28

28

|

Friday August 29

29

|

Saturday August 30

30

|

|

Sunday August 31

31

|

September 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday September 1

1

|

Tuesday September 2

2

|

Wednesday September 3

3

|

Thursday September 4

4

|

Friday September 5

5

|

Saturday September 6

6

|

|

|

Sunday September 7

7

|

Monday September 8

8

|

Tuesday September 9

9

|

Wednesday September 10

10

|

Thursday September 11

11

|

Friday September 12

12

|

Saturday September 13

13

|

|

Sunday September 14

14

|

Monday September 15

15

|

Tuesday September 16

16

|

Wednesday September 17

17

|

Thursday September 18

18

|

Friday September 19

19

|

Saturday September 20

20

|

|

Sunday September 21

21

|

Monday September 22

22

|

Tuesday September 23

23

|

Wednesday September 24

24

|

Thursday September 25

25

|

Friday September 26

26

|

Saturday September 27

27

|

|

Sunday September 28

28

|

Monday September 29

29

|

Tuesday September 30

30

|

October 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday October 1

1

|

Thursday October 2

2

|

Friday October 3

3

|

Saturday October 4

4

|

|||

|

Sunday October 5

5

|

Monday October 6

6

|

Tuesday October 7

7

|

Wednesday October 8

8

|

Thursday October 9

9

|

Friday October 10

10

|

Saturday October 11

11

|

|

Sunday October 12

12

|

Monday October 13

13

|

Tuesday October 14

14

|

Wednesday October 15

15

|

Thursday October 16

16

|

Friday October 17

17

|

Saturday October 18

18

|

|

Sunday October 19

19

|

Monday October 20

20

|

Tuesday October 21

21

|

Wednesday October 22

22

|

Thursday October 23

23

|

Friday October 24

24

|

Saturday October 25

25

|

|

Sunday October 26

26

|

Monday October 27

27

|

Tuesday October 28

28

|

Wednesday October 29

29

|

Thursday October 30

30

|

Friday October 31

31

|

November 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday November 1

1

|

||||||

|

Sunday November 2

2

|

Monday November 3

3

|

Tuesday November 4

4

|

Wednesday November 5

5

|

Thursday November 6

6

|

Friday November 7

7

|

Saturday November 8

8

|

|

Sunday November 9

9

|

Monday November 10

10

|

Tuesday November 11

11

|

Wednesday November 12

12

|

Thursday November 13

13

|

Friday November 14

14

|

Saturday November 15

15

|

|

Sunday November 16

16

|

Monday November 17

17

|

Tuesday November 18

18

|

Wednesday November 19

19

|

Thursday November 20

20

|

Friday November 21

21

|

Saturday November 22

22

|

|

Sunday November 23

23

|

Monday November 24

24

|

Tuesday November 25

25

|

Wednesday November 26

26

|

Thursday November 27

27

|

Friday November 28

28

|

Saturday November 29

29

|

|

Sunday November 30

30

|

December 2025

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday December 1

1

|

Tuesday December 2

2

|

Wednesday December 3

3

|

Thursday December 4

4

|

Friday December 5

5

|

Saturday December 6

6

|

|

|

Sunday December 7

7

|

Monday December 8

8

|

Tuesday December 9

9

|

Wednesday December 10

10

|

Thursday December 11

11

|

Friday December 12

12

|

Saturday December 13

13

|

|

Sunday December 14

14

|

Monday December 15

15

|

Tuesday December 16

16

|

Wednesday December 17

17

|

Thursday December 18

18

|

Friday December 19

19

|

Saturday December 20

20

|

|

Sunday December 21

21

|

Monday December 22

22

|

Tuesday December 23

23

|

Wednesday December 24

24

|

Thursday December 25

25

|

Friday December 26

26

|

Saturday December 27

27

|

|

Sunday December 28

28

|

Monday December 29

29

|

Tuesday December 30

30

|

Wednesday December 31

31

|

No events.

January 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Thursday January 1

1

|

Friday January 2

2

|

Saturday January 3

3

|

||||

|

Sunday January 4

4

|

Monday January 5

5

|

Tuesday January 6

6

|

Wednesday January 7

7

|

Thursday January 8

8

|

Friday January 9

9

|

Saturday January 10

10

|

|

Sunday January 11

11

|

Monday January 12

12

|

Tuesday January 13

13

|

Wednesday January 14

14

|

Thursday January 15

15

|

Friday January 16

16

|

Saturday January 17

17

|

|

Sunday January 18

18

|

Monday January 19

19

|

Tuesday January 20

20

|

Wednesday January 21

21

|

Thursday January 22

22

|

Friday January 23

23

|

Saturday January 24

24

|

|

Sunday January 25

25

|

Monday January 26

26

|

Tuesday January 27

27

|

Wednesday January 28

28

|

Thursday January 29

29

|

Friday January 30

30

|

Saturday January 31

31

|

No events.

February 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday February 1

1

|

Monday February 2

2

|

Tuesday February 3

3

|

Wednesday February 4

4

|

Thursday February 5

5

|

Friday February 6

6

|

Saturday February 7

7

|

|

Sunday February 8

8

|

Monday February 9

9

|

Tuesday February 10

10

|

Wednesday February 11

11

|

Thursday February 12

12

|

Friday February 13

13

|

Saturday February 14

14

|

|

Sunday February 15

15

|

Monday February 16

16

|

Tuesday February 17

17

|

Wednesday February 18

18

|

Thursday February 19

19

|

Friday February 20

20

|

Saturday February 21

21

|

|

Sunday February 22

22

|

Monday February 23

23

|

Tuesday February 24

24

|

Wednesday February 25

25

|

Thursday February 26

26

|

Friday February 27

27

|

Saturday February 28

28

|

No events.

March 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday March 1

1

|

Monday March 2

2

|

Tuesday March 3

3

|

Wednesday March 4

4

|

Thursday March 5

5

|

Friday March 6

6

|

Saturday March 7

7

|

|

Sunday March 8

8

|

Monday March 9

9

|

Tuesday March 10

10

|

Wednesday March 11

11

|

Thursday March 12

12

|

Friday March 13

13

|

Saturday March 14

14

|

|

Sunday March 15

15

|

Monday March 16

16

|

Tuesday March 17

17

|

Wednesday March 18

18

|

Thursday March 19

19

|

Friday March 20

20

|

Saturday March 21

21

|

|

Sunday March 22

22

|

Monday March 23

23

|

Tuesday March 24

24

|

Wednesday March 25

25

|

Thursday March 26

26

|

Friday March 27

27

|

Saturday March 28

28

|

|

Sunday March 29

29

|

Monday March 30

30

|

Tuesday March 31

31

|

No events.

April 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday April 1

1

|

Thursday April 2

2

|

Friday April 3

3

|

Saturday April 4

4

|

|||

|

Sunday April 5

5

|

Monday April 6

6

|

Tuesday April 7

7

|

Wednesday April 8

8

|

Thursday April 9

9

|

Friday April 10

10

|

Saturday April 11

11

|

|

Sunday April 12

12

|

Monday April 13

13

|

Tuesday April 14

14

|

Wednesday April 15

15

|

Thursday April 16

16

|

Friday April 17

17

|

Saturday April 18

18

|

|

Sunday April 19

19

|

Monday April 20

20

|

Tuesday April 21

21

|

Wednesday April 22

22

|

Thursday April 23

23

|

Friday April 24

24

|

Saturday April 25

25

|

|

Sunday April 26

26

|

Monday April 27

27

|

Tuesday April 28

28

|

Wednesday April 29

29

|

Thursday April 30

30

|

No events.

May 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Friday May 1

1

|

Saturday May 2

2

|

|||||

|

Sunday May 3

3

|

Monday May 4

4

|

Tuesday May 5

5

|

Wednesday May 6

6

|

Thursday May 7

7

|

Friday May 8

8

|

Saturday May 9

9

|

|

Sunday May 10

10

|

Monday May 11

11

|

Tuesday May 12

12

|

Wednesday May 13

13

|

Thursday May 14

14

|

Friday May 15

15

|

Saturday May 16

16

|

|

Sunday May 17

17

|

Monday May 18

18

|

Tuesday May 19

19

|

Wednesday May 20

20

|

Thursday May 21

21

|

Friday May 22

22

|

Saturday May 23

23

|

|

Sunday May 24

24

|

Monday May 25

25

|

Tuesday May 26

26

|

Wednesday May 27

27

|

Thursday May 28

28

|

Friday May 29

29

|

Saturday May 30

30

|

|

Sunday May 31

31

|

No events.

June 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday June 1

1

|

Tuesday June 2

2

|

Wednesday June 3

3

|

Thursday June 4

4

|

Friday June 5

5

|

Saturday June 6

6

|

|

|

Sunday June 7

7

|

Monday June 8

8

|

Tuesday June 9

9

|

Wednesday June 10

10

|

Thursday June 11

11

|

Friday June 12

12

|

Saturday June 13

13

|

|

Sunday June 14

14

|

Monday June 15

15

|

Tuesday June 16

16

|

Wednesday June 17

17

|

Thursday June 18

18

|

Friday June 19

19

|

Saturday June 20

20

|

|

Sunday June 21

21

|

Monday June 22

22

|

Tuesday June 23

23

|

Wednesday June 24

24

|

Thursday June 25

25

|

Friday June 26

26

|

Saturday June 27

27

|

|

Sunday June 28

28

|

Monday June 29

29

|

Tuesday June 30

30

|

No events.

July 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday July 1

1

|

Thursday July 2

2

|

Friday July 3

3

|

Saturday July 4

4

|

|||

|

Sunday July 5

5

|

Monday July 6

6

|

Tuesday July 7

7

|

Wednesday July 8

8

|

Thursday July 9

9

|

Friday July 10

10

|

Saturday July 11

11

|

|

Sunday July 12

12

|

Monday July 13

13

|

Tuesday July 14

14

|

Wednesday July 15

15

|

Thursday July 16

16

|

Friday July 17

17

|

Saturday July 18

18

|

|

Sunday July 19

19

|

Monday July 20

20

|

Tuesday July 21

21

|

Wednesday July 22

22

|

Thursday July 23

23

|

Friday July 24

24

|

Saturday July 25

25

|

|

Sunday July 26

26

|

Monday July 27

27

|

Tuesday July 28

28

|

Wednesday July 29

29

|

Thursday July 30

30

|

Friday July 31

31

|

No events.

August 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday August 1

1

|

||||||

|

Sunday August 2

2

|

Monday August 3

3

|

Tuesday August 4

4

|

Wednesday August 5

5

|

Thursday August 6

6

|

Friday August 7

7

|

Saturday August 8

8

|

|

Sunday August 9

9

|

Monday August 10

10

|

Tuesday August 11

11

|

Wednesday August 12

12

|

Thursday August 13

13

|

Friday August 14

14

|

Saturday August 15

15

|

|

Sunday August 16

16

|

Monday August 17

17

|

Tuesday August 18

18

|

Wednesday August 19

19

|

Thursday August 20

20

|

Friday August 21

21

|

Saturday August 22

22

|

|

Sunday August 23

23

|

Monday August 24

24

|

Tuesday August 25

25

|

Wednesday August 26

26

|

Thursday August 27

27

|

Friday August 28

28

|

Saturday August 29

29

|

|

Sunday August 30

30

|

Monday August 31

31

|

No events.

VITA Special Events

IN-PERSON or DROP-OFF TAX PREPARATION SERVICES AVAILABLE.

Note: Appointments are needed for in-person tax preparation.

| Tuesday, June 17 9:00 am – 2:00 pm | Village on Casino Road | 14 E Casino Rd, Everett, WA 98208 | Appointments |

| Monday, August 18 9:00 am – 5:00 pm | Snohomish Library | 311 Maple Ave, Snohomish, WA 98290 | Appointments |

| Friday, October 24 10:00 am – 4:00 pm | Bellevue Mini City Hall | Crossroads Shopping Center, 15600 NE 8th St. #E1, Everett, WA 98208 | Appointments |

| Friday, November 7 10:00 am – 4:00 pm | Bellevue Mini City Hall | Crossroads Shopping Center, 15600 NE 8th St. #E1, Everett, WA 98208 | Appointments |

INFORMATION ABOUT VITA/TCE FREE TAX PROGRAMS

DO I QUALIFY FOR VITA?

Find out if you qualify on the IRS website:

[ View Free Tax Preparation Qualifications ]

APPOINTMENTS:

Appointments usually last 1.5 to 2 hours per tax return.

We provide in-person tax prep and drop-off tax prep services.

Call Aimee Jimenez, 206-565-2961, Option 4 or email at vita@pimsavvy.com.

Call Vanessa Delgado, 206-565-2961, Option 2 or email at vita@pimsavvy.com.

Individual Taxpayer Identification Number (ITIN)

Need help applying for or renewing your ITIN, too? PIM Savvy also provides these services for FREE.

Appointments begin 1/24/25. Contact us today.

All ITIN services are by appointment only.

Las citas comienzan el 1/24/25. Comuníquese con nosotros hoy mismo.

Los servicios de ITIN y VITA (Programa Gratuito de Preparación de Impuestos) se realizan únicamente con cita previa.

IRS Resources

Missed the April 15th Tax-Filing Due Date? File Promptly to Minimize Interest and Penalties

The Internal Revenue Service encourages taxpayers who missed the filing deadline to submit their tax return as soon as possible. Those who missed the deadline to file but owe taxes should file timely to avoid additional penalties and interest.

Gig Economy & PIM Savvy VITA Services

You must file a tax return if you have net earnings from self-employment of $400 or more from gig work. PIM Savvy’s Volunteer Income Tax Assistance (VITA) site can help you file your taxes for FREE if you qualify.

What is an IP PIN and what should you do if you lost your IP PIN or didn’t receive a new one in the mail?

The Internal Revenue Service (IRS) identity protection PIN (IP PIN) is a 6-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number (SSN) on fraudulent federal income tax returns.

How to Get Help from the Internal Revenue Service

Taxes can be confusing and raise a lot of questions such as “How do I file my tax return?” or “How do I check my tax refund status?”. The Internal Revenue Service (IRS) is ready to answer all of your tax-related questions.