PIM Savvy's Free Tax Prep (VITA) Program

PIM Savvy VITA provides FREE IN-PERSON TAX PREPARATION in Renton, Bellevue and Everett. We ensure taxpayers maximize their refunds by claiming all credits they are eligible for, including the federal Earned Income Tax Credit (EITC) and Washington State’s Working Families Tax Credit (WFTC).

Book early because appointments will fill up quickly!

VITA is an IRS-certified program that offers free tax prep to taxpayers who qualify. VITA is a trusted source for preparing tax returns. All VITA volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards.

VITA is an IRS-certified program that offers free tax prep to taxpayers who qualify. VITA is a trusted source for preparing tax returns. All VITA volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards.

100% virtual tax prep and convenient! Upload your tax documents through a secure platform. An IRS-certified VITA volunteer will review your documents and contact you for additional information. Then meet virtually with an IRS-certified tax preparer volunteer through a virtual meeting. Your tax return will be sent back to you for review, and you will meet with a different tax preparer to review it, before it is filed electronically with the IRS.

IRS Direct File allows taxpayers to prepare and file their taxes online – for free – directly with the IRS. Direct File is simple, accurate and secure. This is another option especially if you are short on time for an in-person appointment.

Eligible taxpayers can use IRS Direct File to file their tax returns online with the IRS for FREE! No third party needed. The IRS estimates 920,000 Washington residents are eligible to use Direct File. Find out if you qualify for Direct File today by going to directfile.irs.gov.

In 2025, PIM Savvy will have four (4) VITA sites – Two in Renton and two in Everett plus special events at libraries and community centers and other non-profit locations (in Federal Way, Kent, Bellevue, Mukilteo, and Everett). Use the calendar and table below to find your closest tax site at a time convenient for you.

INFORMATION ABOUT VITA/TCE FREE TAX PROGRAMS

DO I QUALIFY FOR VITA?

Find out if you qualify on the IRS website:

[ View Free Tax Preparation Qualifications ]

APPOINTMENTS:

Appointments usually last 1.5 to 2 hours per tax return.

We provide in-person tax prep services.

We provide in-person tax prep and 100% virtual services.

At this time, all of our FREE tax prep appointments through the end of 2025 are booked. Our free tax prep appointments will open up again in February 2026. Email vita@pimsavvy.com if you have any questions.

IF YOU HAVE QUESTIONS, email vita@pimsavvy.com. Please provide your phone number, question, and name in the email. Or click on the “Ask a Tax Support Question” button and fill out the form.

Call Vanessa Delgado, 206-565-2961, Option 2 or email at vita@pimsavvy.com.

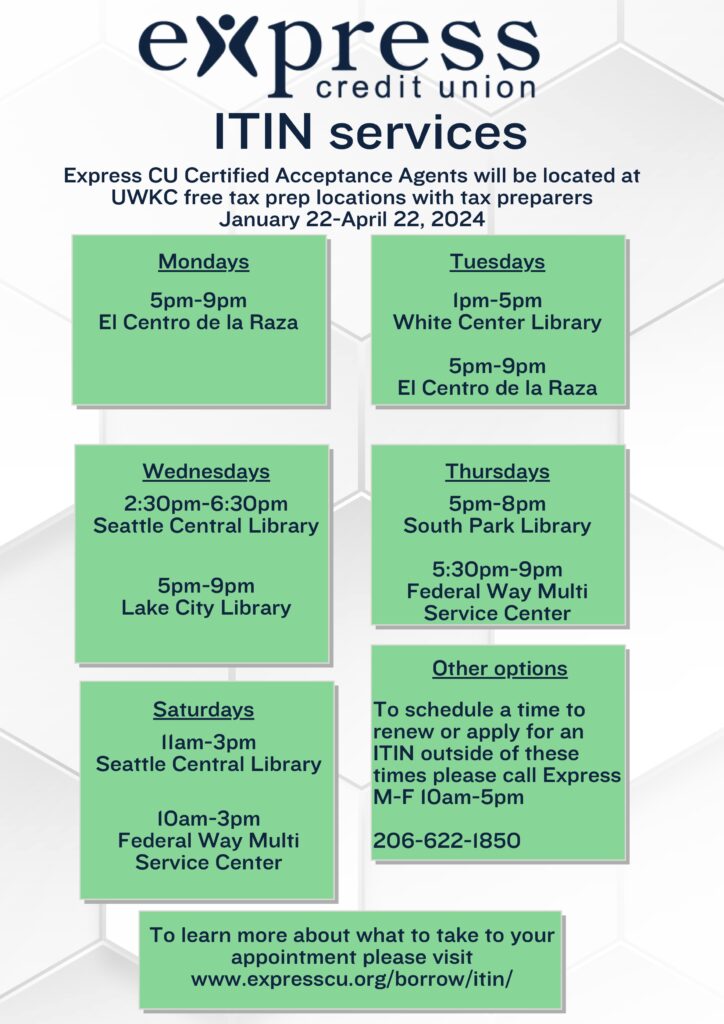

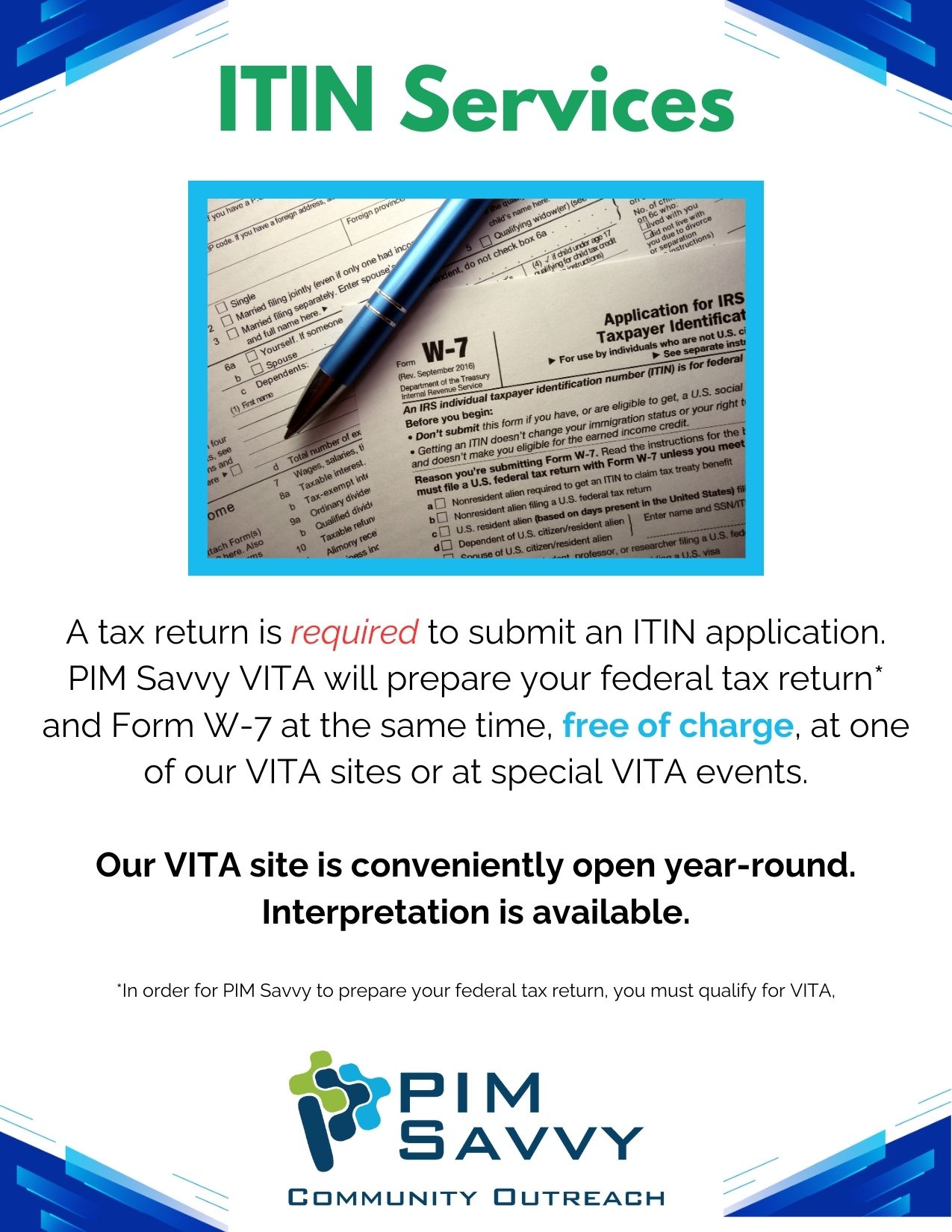

Individual Taxpayer Identification Number (ITIN)

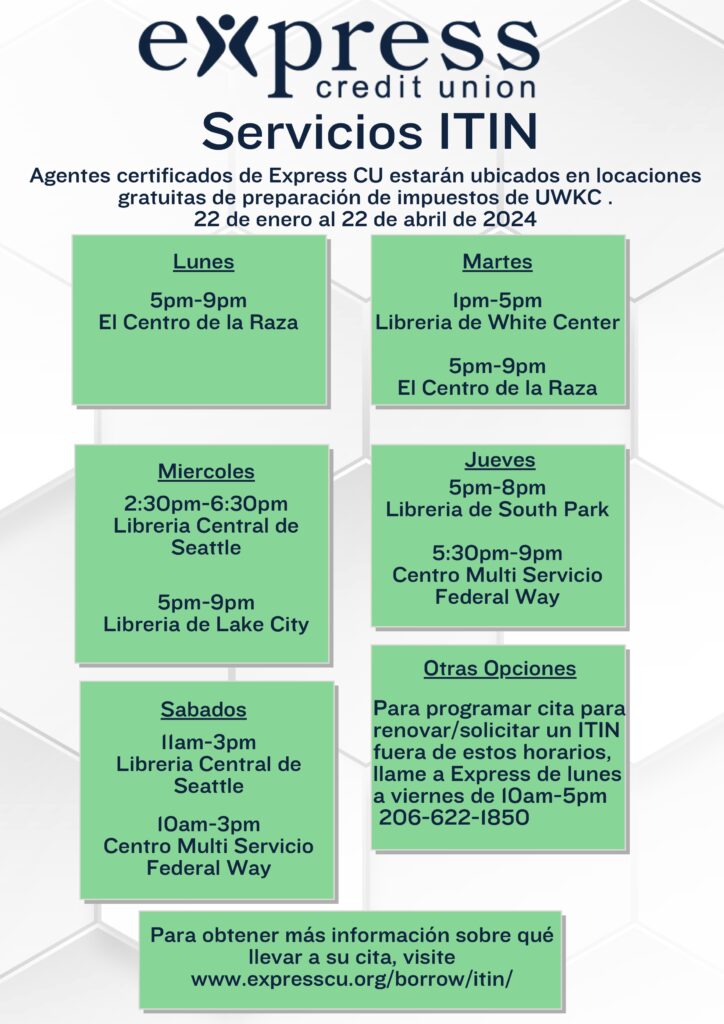

Need help applying for or renewing your ITIN? Express Credit Union provides these services for free. Here are some events through April 22, 2024.

PIM Savvy VITA

Carl Gipson Center

Location

3025 Lombard Ave

Everett, WA, 98201

(Alcove Room)

Additional Locations

Mariner Library

Location

520 128th St SW Suites A9 & A10

Everett, WA 98204

Bellevue Mini City Hall

Location

Crossroads Shopping Center

15600 NE 8th St. #E1

Bellevue, WA 98008

ITIN Application Services

Select days and locations in Renton, Everett and Bellevue at our VITA events.

All ITIN services are by appointment only.

FIND OUT:

What types of income tax forms we can prepare

What we can’t prepare

What to bring to your appointment.

[ View or Download PDF ]

No Appointment Needed for Working Families Tax Credit Application Help

VITA Events - 2026

IN-PERSON TAX PREPARATION SERVICES AVAILABLE.

This is an appointment-only site. Walk-ins are accepted as availability allows if we have cancellations and you are willing to wait. The VITA Site Coordinator will determine if we can add in any walk-in appointments when you arrive.

At this time, all of our FREE tax prep appointments through the end of 2025 are booked. Our free tax prep appointments will open up again in February 2026. Email vita@pimsavvy.com if you have any questions.

March 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday March 1

1

|

Monday March 2

2

|

Tuesday March 3

3

|

Wednesday March 4

4

|

Thursday March 5

5

|

Friday March 6

6

|

Saturday March 7

7

|

|

Sunday March 8

8

|

Monday March 9

9

|

Tuesday March 10

10

|

Wednesday March 11

11

|

Thursday March 12

12

|

Friday March 13

13

|

Saturday March 14

14

|

|

Sunday March 15

15

|

Monday March 16

16

|

Tuesday March 17

17

|

Wednesday March 18

18

|

Thursday March 19

19

|

Friday March 20

20

|

Saturday March 21

21

|

|

Sunday March 22

22

|

Monday March 23

23

|

Tuesday March 24

24

|

Wednesday March 25

25

|

Thursday March 26

26

|

Friday March 27

27

|

Saturday March 28

28

|

|

Sunday March 29

29

|

Monday March 30

30

|

Tuesday March 31

31

|

April 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday April 1

1

|

Thursday April 2

2

|

Friday April 3

3

|

Saturday April 4

4

|

|||

|

Sunday April 5

5

|

Monday April 6

6

|

Tuesday April 7

7

|

Wednesday April 8

8

|

Thursday April 9

9

|

Friday April 10

10

|

Saturday April 11

11

|

|

Sunday April 12

12

|

Monday April 13

13

|

Tuesday April 14

14

|

Wednesday April 15

15

|

Thursday April 16

16

|

Friday April 17

17

|

Saturday April 18

18

|

|

Sunday April 19

19

|

Monday April 20

20

|

Tuesday April 21

21

|

Wednesday April 22

22

|

Thursday April 23

23

|

Friday April 24

24

|

Saturday April 25

25

|

|

Sunday April 26

26

|

Monday April 27

27

|

Tuesday April 28

28

|

Wednesday April 29

29

|

Thursday April 30

30

|

May 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Friday May 1

1

|

Saturday May 2

2

|

|||||

|

Sunday May 3

3

|

Monday May 4

4

|

Tuesday May 5

5

|

Wednesday May 6

6

|

Thursday May 7

7

|

Friday May 8

8

|

Saturday May 9

9

|

|

Sunday May 10

10

|

Monday May 11

11

|

Tuesday May 12

12

|

Wednesday May 13

13

|

Thursday May 14

14

|

Friday May 15

15

|

Saturday May 16

16

|

|

Sunday May 17

17

|

Monday May 18

18

|

Tuesday May 19

19

|

Wednesday May 20

20

|

Thursday May 21

21

|

Friday May 22

22

|

Saturday May 23

23

|

|

Sunday May 24

24

|

Monday May 25

25

|

Tuesday May 26

26

|

Wednesday May 27

27

|

Thursday May 28

28

|

Friday May 29

29

|

Saturday May 30

30

|

|

Sunday May 31

31

|

No events.

June 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday June 1

1

|

Tuesday June 2

2

|

Wednesday June 3

3

|

Thursday June 4

4

|

Friday June 5

5

|

Saturday June 6

6

|

|

|

Sunday June 7

7

|

Monday June 8

8

|

Tuesday June 9

9

|

Wednesday June 10

10

|

Thursday June 11

11

|

Friday June 12

12

|

Saturday June 13

13

|

|

Sunday June 14

14

|

Monday June 15

15

|

Tuesday June 16

16

|

Wednesday June 17

17

|

Thursday June 18

18

|

Friday June 19

19

|

Saturday June 20

20

|

|

Sunday June 21

21

|

Monday June 22

22

|

Tuesday June 23

23

|

Wednesday June 24

24

|

Thursday June 25

25

|

Friday June 26

26

|

Saturday June 27

27

|

|

Sunday June 28

28

|

Monday June 29

29

|

Tuesday June 30

30

|

No events.

July 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Wednesday July 1

1

|

Thursday July 2

2

|

Friday July 3

3

|

Saturday July 4

4

|

|||

|

Sunday July 5

5

|

Monday July 6

6

|

Tuesday July 7

7

|

Wednesday July 8

8

|

Thursday July 9

9

|

Friday July 10

10

|

Saturday July 11

11

|

|

Sunday July 12

12

|

Monday July 13

13

|

Tuesday July 14

14

|

Wednesday July 15

15

|

Thursday July 16

16

|

Friday July 17

17

|

Saturday July 18

18

|

|

Sunday July 19

19

|

Monday July 20

20

|

Tuesday July 21

21

|

Wednesday July 22

22

|

Thursday July 23

23

|

Friday July 24

24

|

Saturday July 25

25

|

|

Sunday July 26

26

|

Monday July 27

27

|

Tuesday July 28

28

|

Wednesday July 29

29

|

Thursday July 30

30

|

Friday July 31

31

|

No events.

August 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday August 1

1

|

||||||

|

Sunday August 2

2

|

Monday August 3

3

|

Tuesday August 4

4

|

Wednesday August 5

5

|

Thursday August 6

6

|

Friday August 7

7

|

Saturday August 8

8

|

|

Sunday August 9

9

|

Monday August 10

10

|

Tuesday August 11

11

|

Wednesday August 12

12

|

Thursday August 13

13

|

Friday August 14

14

|

Saturday August 15

15

|

|

Sunday August 16

16

|

Monday August 17

17

|

Tuesday August 18

18

|

Wednesday August 19

19

|

Thursday August 20

20

|

Friday August 21

21

|

Saturday August 22

22

|

|

Sunday August 23

23

|

Monday August 24

24

|

Tuesday August 25

25

|

Wednesday August 26

26

|

Thursday August 27

27

|

Friday August 28

28

|

Saturday August 29

29

|

|

Sunday August 30

30

|

Monday August 31

31

|

No events.

September 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Tuesday September 1

1

|

Wednesday September 2

2

|

Thursday September 3

3

|

Friday September 4

4

|

Saturday September 5

5

|

||

|

Sunday September 6

6

|

Monday September 7

7

|

Tuesday September 8

8

|

Wednesday September 9

9

|

Thursday September 10

10

|

Friday September 11

11

|

Saturday September 12

12

|

|

Sunday September 13

13

|

Monday September 14

14

|

Tuesday September 15

15

|

Wednesday September 16

16

|

Thursday September 17

17

|

Friday September 18

18

|

Saturday September 19

19

|

|

Sunday September 20

20

|

Monday September 21

21

|

Tuesday September 22

22

|

Wednesday September 23

23

|

Thursday September 24

24

|

Friday September 25

25

|

Saturday September 26

26

|

|

Sunday September 27

27

|

Monday September 28

28

|

Tuesday September 29

29

|

Wednesday September 30

30

|

No events.

October 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Thursday October 1

1

|

Friday October 2

2

|

Saturday October 3

3

|

||||

|

Sunday October 4

4

|

Monday October 5

5

|

Tuesday October 6

6

|

Wednesday October 7

7

|

Thursday October 8

8

|

Friday October 9

9

|

Saturday October 10

10

|

|

Sunday October 11

11

|

Monday October 12

12

|

Tuesday October 13

13

|

Wednesday October 14

14

|

Thursday October 15

15

|

Friday October 16

16

|

Saturday October 17

17

|

|

Sunday October 18

18

|

Monday October 19

19

|

Tuesday October 20

20

|

Wednesday October 21

21

|

Thursday October 22

22

|

Friday October 23

23

|

Saturday October 24

24

|

|

Sunday October 25

25

|

Monday October 26

26

|

Tuesday October 27

27

|

Wednesday October 28

28

|

Thursday October 29

29

|

Friday October 30

30

|

Saturday October 31

31

|

No events.

November 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Sunday November 1

1

|

Monday November 2

2

|

Tuesday November 3

3

|

Wednesday November 4

4

|

Thursday November 5

5

|

Friday November 6

6

|

Saturday November 7

7

|

|

Sunday November 8

8

|

Monday November 9

9

|

Tuesday November 10

10

|

Wednesday November 11

11

|

Thursday November 12

12

|

Friday November 13

13

|

Saturday November 14

14

|

|

Sunday November 15

15

|

Monday November 16

16

|

Tuesday November 17

17

|

Wednesday November 18

18

|

Thursday November 19

19

|

Friday November 20

20

|

Saturday November 21

21

|

|

Sunday November 22

22

|

Monday November 23

23

|

Tuesday November 24

24

|

Wednesday November 25

25

|

Thursday November 26

26

|

Friday November 27

27

|

Saturday November 28

28

|

|

Sunday November 29

29

|

Monday November 30

30

|

No events.

December 2026

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Tuesday December 1

1

|

Wednesday December 2

2

|

Thursday December 3

3

|

Friday December 4

4

|

Saturday December 5

5

|

||

|

Sunday December 6

6

|

Monday December 7

7

|

Tuesday December 8

8

|

Wednesday December 9

9

|

Thursday December 10

10

|

Friday December 11

11

|

Saturday December 12

12

|

|

Sunday December 13

13

|

Monday December 14

14

|

Tuesday December 15

15

|

Wednesday December 16

16

|

Thursday December 17

17

|

Friday December 18

18

|

Saturday December 19

19

|

|

Sunday December 20

20

|

Monday December 21

21

|

Tuesday December 22

22

|

Wednesday December 23

23

|

Thursday December 24

24

|

Friday December 25

25

|

Saturday December 26

26

|

|

Sunday December 27

27

|

Monday December 28

28

|

Tuesday December 29

29

|

Wednesday December 30

30

|

Thursday December 31

31

|

No events.

January 2027

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Friday January 1

1

|

Saturday January 2

2

|

|||||

|

Sunday January 3

3

|

Monday January 4

4

|

Tuesday January 5

5

|

Wednesday January 6

6

|

Thursday January 7

7

|

Friday January 8

8

|

Saturday January 9

9

|

|

Sunday January 10

10

|

Monday January 11

11

|

Tuesday January 12

12

|

Wednesday January 13

13

|

Thursday January 14

14

|

Friday January 15

15

|

Saturday January 16

16

|

|

Sunday January 17

17

|

Monday January 18

18

|

Tuesday January 19

19

|

Wednesday January 20

20

|

Thursday January 21

21

|

Friday January 22

22

|

Saturday January 23

23

|

|

Sunday January 24

24

|

Monday January 25

25

|

Tuesday January 26

26

|

Wednesday January 27

27

|

Thursday January 28

28

|

Friday January 29

29

|

Saturday January 30

30

|

|

Sunday January 31

31

|

No events.

February 2027

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday February 1

1

|

Tuesday February 2

2

|

Wednesday February 3

3

|

Thursday February 4

4

|

Friday February 5

5

|

Saturday February 6

6

|

|

|

Sunday February 7

7

|

Monday February 8

8

|

Tuesday February 9

9

|

Wednesday February 10

10

|

Thursday February 11

11

|

Friday February 12

12

|

Saturday February 13

13

|

|

Sunday February 14

14

|

Monday February 15

15

|

Tuesday February 16

16

|

Wednesday February 17

17

|

Thursday February 18

18

|

Friday February 19

19

|

Saturday February 20

20

|

|

Sunday February 21

21

|

Monday February 22

22

|

Tuesday February 23

23

|

Wednesday February 24

24

|

Thursday February 25

25

|

Friday February 26

26

|

Saturday February 27

27

|

|

Sunday February 28

28

|

No events.

March 2027

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Monday March 1

1

|

Tuesday March 2

2

|

Wednesday March 3

3

|

Thursday March 4

4

|

Friday March 5

5

|

Saturday March 6

6

|

|

|

Sunday March 7

7

|

Monday March 8

8

|

Tuesday March 9

9

|

Wednesday March 10

10

|

Thursday March 11

11

|

Friday March 12

12

|

Saturday March 13

13

|

|

Sunday March 14

14

|

Monday March 15

15

|

Tuesday March 16

16

|

Wednesday March 17

17

|

Thursday March 18

18

|

Friday March 19

19

|

Saturday March 20

20

|

|

Sunday March 21

21

|

Monday March 22

22

|

Tuesday March 23

23

|

Wednesday March 24

24

|

Thursday March 25

25

|

Friday March 26

26

|

Saturday March 27

27

|

|

Sunday March 28

28

|

Monday March 29

29

|

Tuesday March 30

30

|

Wednesday March 31

31

|

No events.

April 2027

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Thursday April 1

1

|

Friday April 2

2

|

Saturday April 3

3

|

||||

|

Sunday April 4

4

|

Monday April 5

5

|

Tuesday April 6

6

|

Wednesday April 7

7

|

Thursday April 8

8

|

Friday April 9

9

|

Saturday April 10

10

|

|

Sunday April 11

11

|

Monday April 12

12

|

Tuesday April 13

13

|

Wednesday April 14

14

|

Thursday April 15

15

|

Friday April 16

16

|

Saturday April 17

17

|

|

Sunday April 18

18

|

Monday April 19

19

|

Tuesday April 20

20

|

Wednesday April 21

21

|

Thursday April 22

22

|

Friday April 23

23

|

Saturday April 24

24

|

|

Sunday April 25

25

|

Monday April 26

26

|

Tuesday April 27

27

|

Wednesday April 28

28

|

Thursday April 29

29

|

Friday April 30

30

|

No events.

May 2027

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

|---|---|---|---|---|---|---|

|

Saturday May 1

1

|

||||||

|

Sunday May 2

2

|

Monday May 3

3

|

Tuesday May 4

4

|

Wednesday May 5

5

|

Thursday May 6

6

|

Friday May 7

7

|

Saturday May 8

8

|

|

Sunday May 9

9

|

Monday May 10

10

|

Tuesday May 11

11

|

Wednesday May 12

12

|

Thursday May 13

13

|

Friday May 14

14

|

Saturday May 15

15

|

|

Sunday May 16

16

|

Monday May 17

17

|

Tuesday May 18

18

|

Wednesday May 19

19

|

Thursday May 20

20

|

Friday May 21

21

|

Saturday May 22

22

|

|

Sunday May 23

23

|

Monday May 24

24

|

Tuesday May 25

25

|

Wednesday May 26

26

|

Thursday May 27

27

|

Friday May 28

28

|

Saturday May 29

29

|

|

Sunday May 30

30

|

Monday May 31

31

|

No events.

| Wednesday, February 11th 12:00pm – 5:00pm | Bellevue Mini City Hall | Crossroads Shopping Center, 15600 NE 8th St. #E1, Bellevue, WA 98008 | Appointments |

| Friday, February 20th 10:00am – 6:00pm | Renton Library | 100 Mill Ave S, Renton, WA 98057 | Appointments |

| Monday, February 23rd 8:30am – 6:00pm | Carl Gipson Center | 3025 Lombard Ave, Everett, WA, 98201 (Alcove Room) | Appointments |

| Wednesday, February 25th 12:00pm – 5:00pm | Bellevue Mini City Hall | Crossroads Shopping Center, 15600 NE 8th St. #E1, Bellevue, WA 98008 | Appointments |

| Friday, February 27th 9:00am – 7:00pm | The Village on Casino Road | 14 E Casino Rd, Everett, WA 98208 | Appointments |

| Saturday, February 28th 11:00am – 6:00pm | Renton Library | 100 Mill Ave S, Renton, WA 98057 | Appointments |

| Monday, March 2nd 8:30am – 6:00pm | Carl Gipson Center | 3025 Lombard Ave, Everett, WA, 98201 (Alcove Room) | Appointments |

| Tuesday, March 3rd 10:00am – 7:00pm | Mariner Library | 520 128th St SW, Suites A9 & A10, Everett, WA 98204 | Appointments |

| Wednesday, March 11th 12:00pm – 5:00pm | Bellevue Mini City Hall | Crossroads Shopping Center, 15600 NE 8th St. #E1, Bellevue, WA 98008 | Appointments |

| Friday, March 13th 10:00am – 6:00pm | Renton Library | 100 Mill Ave S, Renton, WA 98057 | Appointments |

| Saturday, March 14th 9:00am – 7:00pm | The Village on Casino Road | 14 E Casino Rd, Everett, WA 98208 | Appointments |

| Monday, March 16th 8:30am – 6:00pm | Carl Gipson Center | 3025 Lombard Ave, Everett, WA, 98201 (Alcove Room) | Appointments |

| Friday, March 20th 10:00am – 6:00pm | Mariner Library | 520 128th St SW, Suites A9 & A10, Everett, WA 98204 | Appointments |

| Saturday, March 21st 11:00am – 6:00pm | Renton Library | 100 Mill Ave S, Renton, WA 98057 | Appointments |

| Monday, March 23rd 8:30am – 6:00pm | Carl Gipson Center | 3025 Lombard Ave, Everett, WA, 98201 (Alcove Room) | Appointments |

| Wednesday, March 25th 12:00pm – 5:00pm | Bellevue Mini City Hall | Crossroads Shopping Center, 15600 NE 8th St. #E1, Bellevue, WA 98008 | Appointments |

| Friday, March 27th 9:00am – 7:00pm | The Village on Casino Road | 14 E Casino Rd, Everett, WA 98208 | Appointments |

| Monday, March 30th 8:30am – 6:00pm | Carl Gipson Center | 3025 Lombard Ave, Everett, WA, 98201 (Alcove Room) | Appointments |

| Tuesday, March 31st 10:00am – 5:30pm | Mariner Library | 520 128th St SW, Suites A9 & A10, Everett, WA 98204 | Appointments |

| Friday, April 3rd 9:00am – 7:00pm | The Village on Casino Road | 14 E Casino Rd, Everett, WA 98208 | Appointments |

| Monday, April 13th 8:30am – 6:00pm | Carl Gipson Center | 3025 Lombard Ave, Everett, WA, 98201 (Alcove Room) | Appointments |

INFORMATION ABOUT VITA/TCE FREE TAX PROGRAMS

DO I QUALIFY FOR VITA?

Find out if you qualify on the IRS website:

[ View Free Tax Preparation Qualifications ]

Note: PIM Savvy VITA offers free tax preparation assistance to taxpayers who generally earn $86,000 or less. PIM Savvy VITA’s income limit is higher than the IRS VITA income limit due to the cost of living in the Seattle area.

APPOINTMENTS:

Appointments usually last 1.5 to 2 hours per tax return.

We provide in-person tax prep and drop-off tax prep services.

At this time, all of our FREE tax prep appointments through the end of 2025 are booked. Our free tax prep appointments will open up again in February 2026. Email vita@pimsavvy.com if you have any questions.

IF YOU HAVE QUESTIONS, email vita@pimsavvy.com. Please provide your phone number, question, and name in the email. Or click on the “Ask a Tax Support Question” button and fill out the form.

Call Vanessa Delgado, 206-565-2961, Option 2 or email at vita@pimsavvy.com.

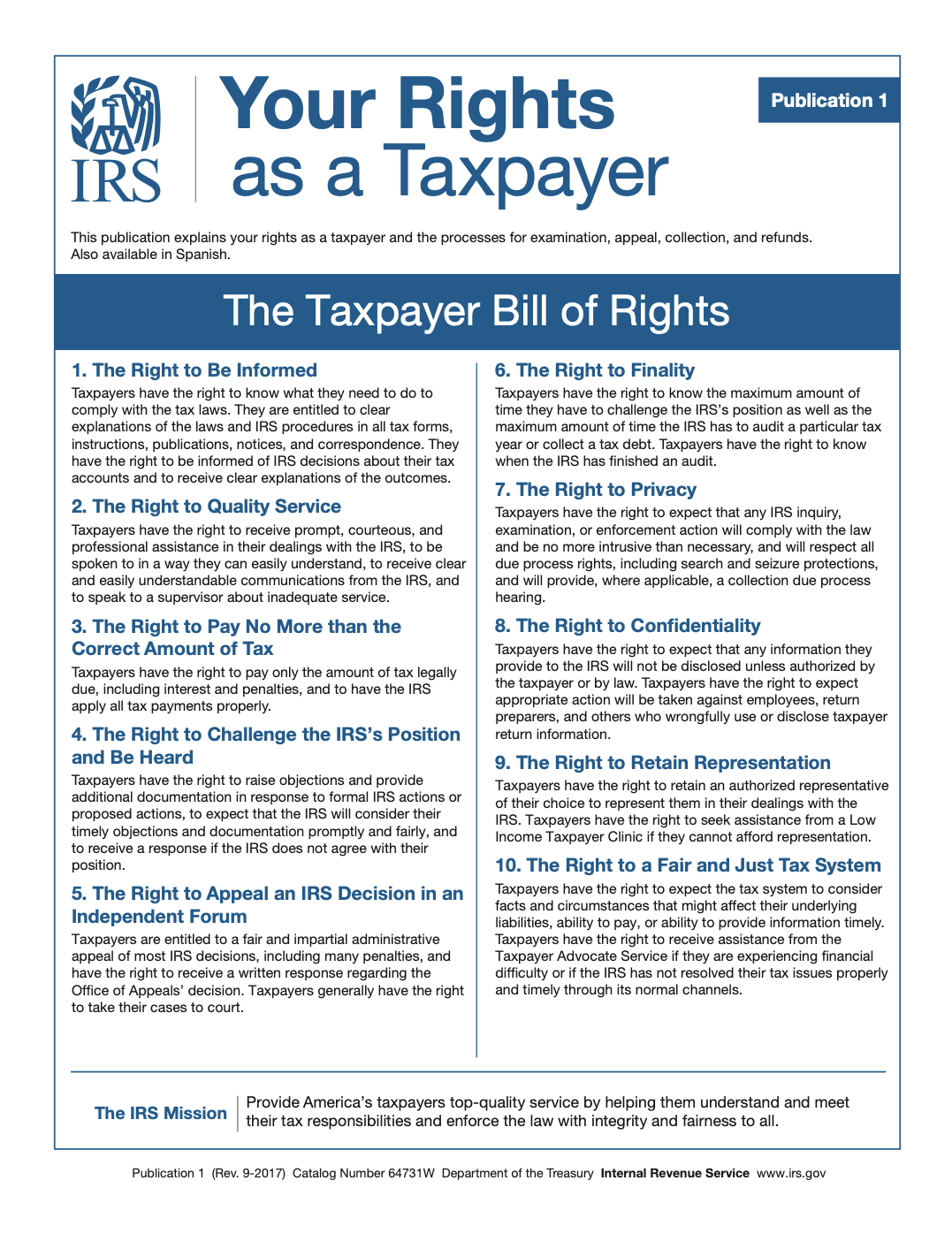

Receiving notices from the IRS can be intimidating, let alone collection notices.

Here is information on the Taxpayers Bill of Rights regarding collection notices from the IRS. If you receive balance due notices, this informs you of your rights.

Testimonials

Individual Taxpayer Identification Number (ITIN)

Need help applying for or renewing your ITIN, too? PIM Savvy also provides these services for FREE when individuals who qualify for VITA services.

Fill out the form on this page and we will contact you with the details.

The IRS Taxpayer Assistance Centers also help with ITIN applications. Call 844-545-5640 to schedule an appointment with the IRS.

All ITIN services are by appointment only.

Comuníquese con nosotros hoy mismo.

Los servicios de ITIN y VITA (Programa Gratuito de Preparación de Impuestos) se realizan únicamente con cita previa.

IRS Resources

Missed the April 15th Tax-Filing Due Date? File Promptly to Minimize Interest and Penalties

The Internal Revenue Service encourages taxpayers who missed the filing deadline to submit their tax return as soon as possible. Those who missed the deadline to file but owe taxes should file timely to avoid additional penalties and interest.

Gig Economy & PIM Savvy VITA Services

You must file a tax return if you have net earnings from self-employment of $400 or more from gig work. PIM Savvy’s Volunteer Income Tax Assistance (VITA) site can help you file your taxes for FREE if you qualify.

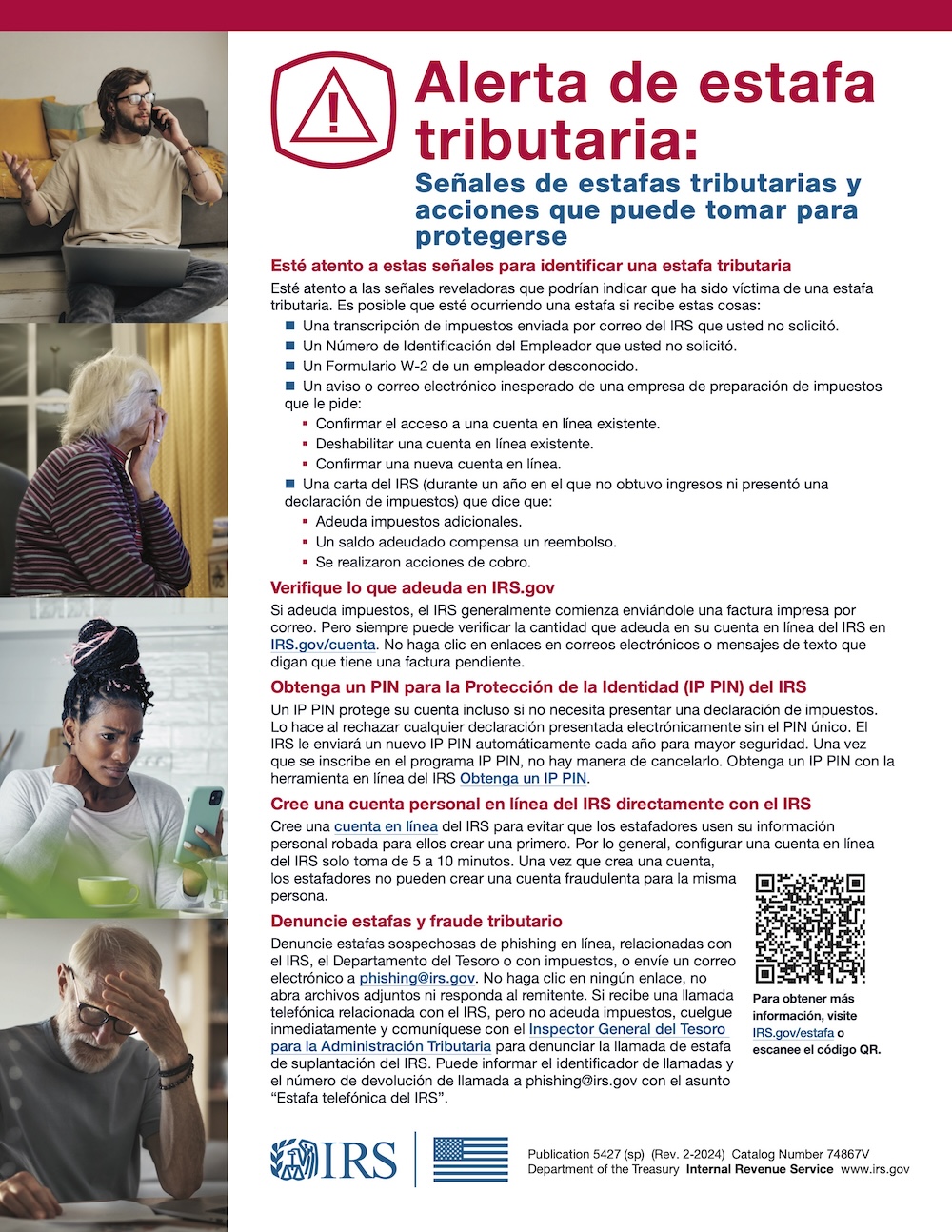

What is an IP PIN and what should you do if you lost your IP PIN or didn’t receive a new one in the mail?

The Internal Revenue Service (IRS) identity protection PIN (IP PIN) is a 6-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number (SSN) on fraudulent federal income tax returns.

How to Get Help from the Internal Revenue Service

Taxes can be confusing and raise a lot of questions such as “How do I file my tax return?” or “How do I check my tax refund status?”. The Internal Revenue Service (IRS) is ready to answer all of your tax-related questions.