WHO – Who is eligible for the Working Families Tax Credit?

- Individuals and families are eligible for the Working Families Tax Credit if they meet all of the following requirements:

- Have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Lived in Washington a minimum of 183 days in 2022 (over half the year).

- Are at least 25 and under 65 years of age OR have a qualifying child in 2022.

-

- Filed a 2022 federal tax return.

- Eligible to claim the federal Earned Income Tax Credit (EITC) on their 2022 tax return (or would meet to requirements for EITC but are filing with an ITIN)

Note: Washington workers do not have to be currently employed to receive the credit but to be eligible they must have earned income in 2022

Home | Washington State Working Families Tax Credit.

#WorkingFamilies #taxcredit #WATaxCredit

- Qualifying child

- The rules for qualifying children are based on the federal Earned Income Tax Credit (EITC). These rules involve the child’s age, relationship, and residency.

- See IRS qualifying child rules for EITC

- Under Washington’s credit, a qualifying child can have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

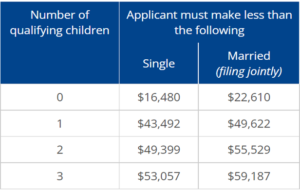

- Income requirements

- The income limits are based on the federal Earned Income Tax Credit (ETIC). See below for the income limits for the 2022 tax year.

- If a person has income from investments, the limit is $10,300 or less.

Visit http://familytaxcreditwa.com/ or call/email PIM Savvy at 206-565-2961 option 3, info@pimsavvy.com for all of the details. #WorkingFamilies #taxcredit #WATaxCredit