HOW – How much money will I get back from the Working Families Tax Credit and how will I receive the money?

- The credit amount varies depending on the number of qualifying children and income level.

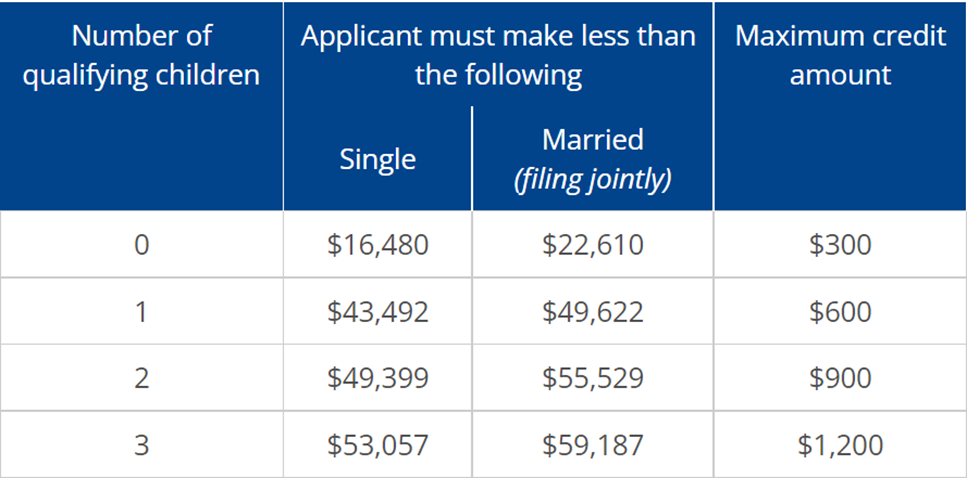

- The maximum credit amount ranges from $300 to $1,200 depending on the number of qualifying children (see table below). These amounts are then reduced based on income thresholds, similar to the federal program. The minimum credit amount is $50, regardless of the number of qualifying children. See below for maximum credit amounts.

- At this time, Washington residents will have two payment options available for their WFTC refund. They will be able to choose either direct deposit or a check.

Visit http://familytaxcreditwa.com/ or call/email PIM Savvy at 206-565-2961 option 3, info@pimsavvy.com for all of the details. #WorkingFamilies #taxcredit #WATaxCredit